Mobility in 2050 – Part III

At the end of “Mobility in 2050 - Part II”, I wrote: “We’re living a pivotal moment in history at which the future of mobility is taking shape.”

This decade might indeed become a pivotal moment for electromobility in particular and for mobility at large, provided …. we outline a decent strategy to get there.

To get where? To a point where all vehicles are automated and equipped with swappable batteries. To get there when? Ultimately by 2050, but prior if possible.

It is possible to get a fully clean, flexible and integrated mobility by 2050, but …

there is still a long way to go!

As you could read in Part I and Part II of the articles on Mobility in 2050, it is possible to get a fully clean, flexible and integrated mobility by 2050, but … there is still a long way to go! In Part III, I will outline how we can get there within the coming 30 years, or even earlier, provided politicians and the industry are ready to unify forces and support bold evolutions.

Where are we today?

This is a very good question: “where are we today?”. Quite remarkably, one can find very diverging figures, depending on the source and the interpretation of these figures. In order to create a common ground, the figures in this article are extracted from the Annual Report 2020 of FEBIAC (1) (for Belgium) and of the ACEA report (2) “Vehicles in Use in Europe – January 2021” (for Europe). We can consider these figures as recent, objective and undisputable.

When figures are different from these, this is very often due to the fact that PHEV (Plug-in Hybrid Electric Vehicles) are considered as well as “Electric Vehicles”, although they aren’t. In most cases, they are driven like a traditional ICE-vehicle, thus generating > 140 gr. CO2/km, since they’re not optimized for such a usage. So, they are NOT a contributor to the Clean Air efforts, we all have to make within the coming decades, … on the contrary! PHEVs are jeopardizing a lot of efforts!

But, let’s have a look for a while at where it all started. In an article on the website of the US Energy Department (3), we read: “By 1900, electric cars were at their heyday, accounting for around a third of all vehicles on the road. During the next 10 years, they continued to show strong sales.” So, back in 1900, the market share of the BEV was about 33 %.

Today, in Belgium, the actual market share is 0,32 % (1). This is 100 times smaller! And on European level, it is even worse, since the overall market share of BEVs is 0,2 % (2). This of course without Norway, since Norway is not part of the EU. Later on, I will come back on the so-called Norwegian Success Story.

And the ambition is to evolve towards 100 % by 2050?

When we hear politicians of all color declare that we will have energy neutrality by 2050 and when at that very moment we have to have an emission free mobility, it’s clear that the way is steep and long. Is the European Green Deal a dream? Is the Paris Climate agreement an unrealistic ambition? Maybe. In case we continue the way, we’re tackling the problems, it will! For sure. Hence, we have to change our approach and make BEV “sexy” enough for citizens to buy one. That’s the real challenge. A challenge that – surprisingly enough - the OEMs didn’t discover so far.

We have to change our approach and make BEV “sexy” enough for citizens to buy one.

How to close the gap?

How to close the gap between 0,32 % and 100 % … and how to close it between now and 2050? The 2 previously published articles on “Mobility in 2050” are focusing on the ideal situation at a given point in time, 30 years from now. Indeed, in both previous articles, I’ve given a projection on how mobility might look like in 2050, without clarifying how we can get there through a smooth transition between our actual mobility model and what it is supposed to be in 2050 and beyond. The remaining question, which will get answered right here, is: “How to get there?”

The remaining question, which will get answered right here, is: “How to get there?”

At first, I will come back to Fig. 1 in Mobility in 2050 – Part II and elaborate this one a little more in detail.

Fig. 1 Overview of the vehicle mix in Belgium (Source: Febiac) and Forecast for an evolution towards a full MaaS and ADEM based mobility model.

At this table, it was mentioned, and indicated with a (*), that the very last PDCs (Person Driven Cars) might also become Autonomous Driving, hence ending up with a 100 % automated fleet on our roads. Although Automation is not the key subject of this article, but Electrification instead, we’ll include it for a while and extend our forecast towards 2060, when the last PDC might be converted into its ADEM equivalent and road mobility will be completely automated.

Remarque: I deliberately do not make any projection on growth in population or on increase or decrease in mobility, although these might influence our mobility as well. That’s completely out of scope and might being influenced by factors, which are hard to predict. The Corona pandemic and consequent home office labor has made that mobility in 2020 has dropped significantly, compared to 2019. Hence, in this analysis, total distance/year per person has remained unchanged, as well as the number of vehicles in the B2B-categories. It’s only within the B2C-category, that we’ve projected an increase in efficiency from 2,85 % per car towards nearly 100 % of efficiency.

The evolution of the fleet on our roads within the coming decades.

The different categories of vehicles will be split up more a little more in detail in order to have a better view on the individual evolutions.

Fig. 2 Overview of the vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards a full MaaS and 100 % ADEM based mobility model by 2060

B2C Vehicles, also called Passenger Cars

At first, we’ll take a look at the passenger cars. This includes all type of passenger cars:

· Individually owned

· Collectively owned fleets (e.g. company cars, …)

· Professional used cars (e.g. car sharing, taxi, ... )

Fig. 3 Overview of the B2C vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards a full MaaS and 100 % ADEM based mobility model by 2060.

At this very moment there are in Belgium, according to Febiac (1), about 5.800.000 B2C vehicles, also called Passenger Cars. Only roughly 20.000 of them (in fact: 18.523 vehicles (1)) are full electric vehicles or BEV. Let’s focus in detail on those 5,8 million Passenger Cars.

At this very moment there are in Belgium 18.523 full electric vehicles or BEV

We make distinction between the cars, used by professionals, whose job is exclusively possible thanks to the use of that car and cars, used by users, be it private or even professionally, for whom the use of that car is fantastic, but an instantaneous availability is not really necessary. These last users might make use of a so-called On Demand vehicle and are thus candidate to make use of an ADEM (Automated Driving Electric Mobility) as soon as these vehicles will be available.

We indicate them as ICE PDC-1 and indicate them as “convertible from PDC with ICE towards ADEM”. We estimate their number at 5 million. As the ADEM cars will only be available by 2040, we have to consider an intermediate step, where a number of them will first migrate from ICE towards CC (Conductive Charging) in 2030, before being converted into Battery Swap from 2030 onwards. That’s why we see an increase of BEV CC in 2030, up to 5 % of the global B2C fleet, before being halved by 2040 and finally completely disappear by 2050.

The other group, indicated as ICE PDC-2 and estimated at roughly 800.000 cars, will continue to drive an ICE until 2030, before starting to migrate towards BEV. Since we expect at that moment Battery Swap to be available, we proclaim them as “convertible from ICE towards S2E (Swap2drivE)”. We expect them to be converted for 50% by 2040 from ICE towards Battery Swap, before the ICE finally will completely fade away by 2050.

The 3rd group, indicated as BEV CC, is the group of BEV as we know them actually. Despite the limited success of this group so far, we expect them anyhow to grow still within the coming 10 years, before fading away, being halved by 2040 and disappear completely by 2050.

So far, the actually existing categories B2C cars: the ICE vehicles and the BEV CC. But what about the newcomers: BEV S2E and BEV ADEM?

First, we have to clarify that ADEM is also equipped with Battery Swap and thus is an S2E vehicle as well, but on top of that is Automated Driving, hence the denomination Automated Driving Electric Mobility or ADEM.

Battery Swap is gaining

momentum in China

Actually, both categories are not yet present on the Belgian market, nor in the rest of Europe, while Battery Swap is gaining momentum in China with protagonists like NIO, Beijing EV (subsidiary of the BAIC Group), Geely and others. This whole development is pushed forward by China's Ministry of Industry and Information Technology (MIIT) through research at the China Automotive Technology Research Center. It is clear that the Chinese EV industry is cementing a leadership position in the future of the global EV market.

It is clear that the Chinese EV industry is cementing a leadership position in the future of the global EV market.

Nio even introduced an own Battery as a Service (BaaS) model, comparable to the Swap2drivE model.

Nio actually has a lot of activity on Social Media and gets a lot of attention in the Press.

Fig 4. Screen shot from article on Nio’s efforts to accelerate development of the next-gen battery swap station.

The fact that Nio shares at the NYSE are boosting is not a big surprise. On the contrary!

But suppose that Europe very soon realizes it has to change strategy and embrace Battery Swap and ADEM as well, then we might see a quick take off with roughly 2,5 million ICE passenger cars in Belgium converted towards ADEM by 2040 and the remaining 2,5 million finally by 2050. This will result in about 200.000 ADEM vehicles, since they are available at nearly 100 % of the time and thus much more efficient, as was outlined in Mobility in 2050 – Part II.

At the same time around 2030, the ICE PDC-2 will stop converting ICE towards BEV CC and start converting towards Battery Swap as well, given de convenience of this model. By 2040, we see roughly 50% of these 800.000 vehicles converted towards Battery Swap, the remainder still being ICE, while by 2050 the complete fleet will be converted towards Battery Swap and become BEV S2E.

The ADEM itself, which strongly depends on the progress on Automated Driving, may be expected to become certified and start to appear on our roads by 2030 and take-off within the decade that follows. By 2040, we can expect to have already roughly 100.000 units on our roads and this will be doubled between 2040 and 2050.

Fig. 5 Forecast on the evolution of the B2C vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060.

Hence, by 2050, we will thus be able to enjoy a 100% clean fleet in our streets, which will be much smaller than today’s fleet, due to vehicle usage optimization. To some, it may look strange, but clearly, this is the only way to get there!

B2B-1 Vehicles, also called Light Utility Vehicles (≤ 3,5 Ton)

We will now take a closer look at the Light Utility Vehicles, of which there are about 900.000 units in Belgium (1) and roughly 28 million in Europe (2). We expect these to evolve from a full ICE fleet towards a full S2E fleet by 2050, with an intermediate step of roughly 50% penetration in 2040. Ultimately, this fleet might also become Automated Driving by 2060, but that’s not the subject of this paper, as outlined earlier on.

In or around 2030, some of them might make an intermediate stop at CC, prior to move to Battery Swap, although chances are very little since these are commercially used vehicles and a commercial vehicle, standing still at a charging pole, in order to get energized, is “dead capital” and no single entrepreneur is interested in dead capital. That’s why we deliberately ignore this option as the likelihood is really negligible.

A commercial vehicle, standing still at a charging pole, in order to get energized, is “dead capital” and no single entrepreneur is interested in dead capital.

Fig. 6 Overview of the B2B-1 vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards fully Electrified by 2050 and 100 % ADEM by 2060.

Fig. 7 Forecast on the evolution of the B2B-1 vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060.

B2B-2 Vehicles, also called Heavy Utility Vehicles (> 3,5 Ton)

When looking at the Heavy Utility Vehicles, of which there are about 95.000 units in Belgium (1) and some 6 million units in Europe (2), the situation is even more outspoken. Likewise, they will evolve from a full ICE fleet towards a full S2E fleet by 2050, with an intermediate step of roughly 50% penetration in 2040. Ultimately, this fleet might also become Automated Driving by 2060, once all other vehicles are becoming Automated Driving, but that’s not the subject of this paper, as outlined earlier on.

In this category, the likeliness of an intermediate stop at CC, prior to move to Battery Swap, is for sure not going to happen, since these are 100% commercially used vehicles and a commercial vehicle, standing still at a charging pole, in order to get energized, is “dead capital”. No single entrepreneur will invest in dead capital. That’s why this option is complete ignored, since the likelihood is really nonexistent.

Fig. 8 Overview of the B2B-2 vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards fully Electrified by 2050 and 100 % ADEM by 2060.

Fig. 9 Forecast on the evolution of the B2B-2 vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060.

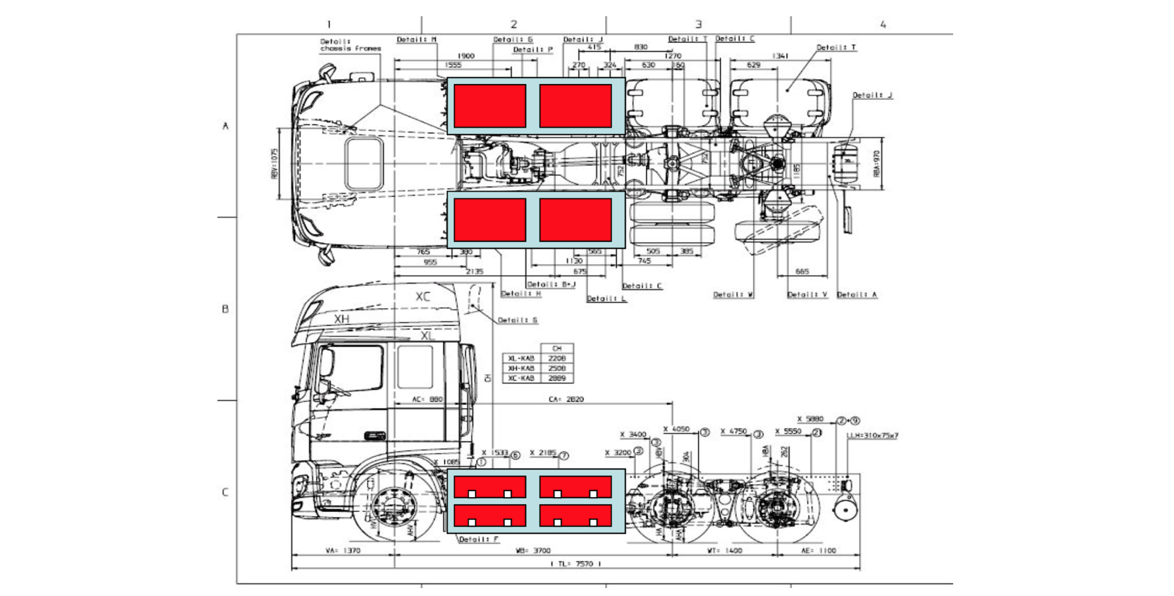

A Heavy Utility Vehicle can contain multiple 30 kWh batteries, thus giving it an autonomy of several hundreds of km, so that this vehicle has an autonomy, which is sufficient for a full working day (5).

Fig. 10 A Heavy Utility Vehicle, transformed to contain up to 8 30 KWh swappable batteries, thus giving it an autonomy of about 240 km after a full swap. Courtesy: DAF Trucks

B2B-3 Vehicles, also called Busses and Touring Cars

While Busses have completely different needs than Touring Cars, they mostly are accumulated within the same category. In Belgium, there are 15.000 B2B-3 Vehicles (1). The total number for Europe is about 700.000 units (2).

This type of Touring Cars, once evolved towards electric propulsion, not only needs “swappable drivers” but also swappable batteries.

A Bus might need an autonomy of a few hundred km/day, while a Touring Car needs a lot more. In some cases, when it’s driven by a team of drivers, this can go up to 2000 km/24 hours. This type of Touring Cars, once evolved towards electric propulsion, not only needs “swappable drivers” but also swappable batteries.

For both categories, multiple technical implementations are possible (5).

In this paper, we’ll only look at the numbers. Hence we may look-up next table:

Fig. 11 Overview of the B2B-3 vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards fully Electrified by 2050 and 100 % ADEM by 2060.

Fig. 12 Forecast on the evolution of the B2B-3 vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060.

Which are the Success Factors?

The very first chapter of this paper tried to answer the question: “Where are we today?” and the honest answer is “Almost nowhere!”. It’s hard to attribute to a market penetration of only 0,32 % a more appealing predictive than this one, isn’t it?

The OEMs did’t discover so far how to get their offering appealing and sexy!

But then pops up next question: “How could it come so far?” and obviously “What can we do to improve this situation and saveguard the objectives of the EU Green Deal and the Paris Climate agreement?”

Here are the answers:

On the 1st question, as I already said earlier, the OEMs did’t discover so far how to get their offering appealing and sexy. Indeed, up to now, the guys and girls in the executive boardrooms didn’t go out and talk with their clients. They only looked up their spreadsheets and decided to add another year “of the same” on top of it. Pushed by the governments, they only found out some software tricks, now indicated as Dieselgate or published some misleading documents, indicated as Astongate. Well done, OEMs, well done! You might have been some more creative, isn’t it? I really get angry when I hear them quote: “Citizens still have fear to move towards EV”. Sorry to say, but it’s nothing about "having fear", it’s just about "common sense"! Hence, stop blaming the citizen, start talking to him or her, start listening, understand the requirements and return to your drawing tables.

Hence, stop blaming the citizen, start talking to him or her, start listening, understand the requirements and return to your drawing tables.

Here's why! Up to now, BEVs all have the same inconveniences:

1. Their range is limited. In order to overcome this inconvenience, they bring more battery capacity on board, thus increasing the weight and by consequence the energy consumption/km, as well as the price.

2. The charging time still is a huge inconvenience, since “Time = Money”. Even for unemployed or retired people, time still = money. The OEMs, jointly with the “charging pole lobby”, are increasing the charging capacity per charging pole up to fast chargers, who charge at 150 kW and more. This is killing the lifetime of the battery, which in the end is by far the most expensive component of the vehicle. On top of that, it’s killing the energy grids.

3. The acquisition cost of such a BEV. The more battery capacity they install, in order to cope with the range issue, the more expensive the vehicle becomes. Hence a BEV still is much more expensive than an ICE equivalent car. Subsidies might help for a while, but in the end, these are coming from taxes and excises. Hence, this is a Shifting of Funds transaction.

By migrating towards a Battery Swap model, all these inconveniences are disappearing at once and new business models are becoming available, like Battery as a Service (BaaS)

On the 2nd question, the answer is quite obvious as well: by migrating towards a Battery Swap model, all these inconveniences are disappearing at once and new business models are becoming available, like Battery as a Service (BaaS). Moreover, the Battery Recharging Stations (BRS) will act as energy storage hubs within the Smart Energy Grids, once they’re fully powered by Renewable Energy (Solar, Wind, …). At the same time, these hubs can be used by the Energy Utilities to perform Peak Shaving, at moments where the Demand is higher than the Supply. It can even be used to offer Frequency Regulation as well.

The Norwegian Success Story

I promised to come back on the “so called” Norwegian Success Story. Here I am with it. Why Norway has a 9,4 % BEV market share (2). No one can understand this discrepancy with the poor 0,2 % market share in the EU (2).

Norway is in that sense different to all other countries of the EU, that … it’s an oil producing country. Like the countries in the Arab world or in the US (e.g. Exxon), Norway is one of the major crude oil producing countries in the world. With their 5 million inhabitants, they’re among the richest people on earth … for as long as we continue using ICE cars and are dependent on their oil production capacity. Hence, investing in very expensive cars is not an issue at all for Norwegian citizens. Charging at home is not an issue either, since almost all parking places in the Nordics are equipped with heaters to preheat the motor of an ICE vehicle. This infrastructure can be used to charge the battery at home. And, last but not least, since investment is not an issue, they can easily afford a car with a very large battery pack. As such, they became the number 1 market for Elon Musk and his Tesla company and made him the richest person on earth.

On top of that, the Norwegian Government is offering a bunch of advantages to the BEV-drivers. They are allowed to use the bus lanes, hence overcoming traffic jams, and many more. The Norwegian Government has financial means, no one country in Europe can even dream of. Hence, no single country is able to copy “the Norwegian Success Story”.

Would you buy an EV from Sony?

The line between electronics giants and automakers could soon fade, as the industry turns to EVs.

This question may surprise you, but it’s the title of an article, published recently on Autoweek.com (6). The line between electronics giants and automakers could soon fade, as the industry turns to EVs. Indeed, after newcomers like Tesla and Nio and after also Apple announced having some interest in becoming a Car Producer and Seller, other companies, like Sony, are knocking on the door and announcing their interest in this new and very promising BEV opportunity. A car nowadays is becoming more and more an “ICT-solution on wheels”, rather than a vehicle and since those companies have learned to listen to their clients, they might have a good chance to beat the traditional OEMs onto their own battleground. Very surprising, but inspiring at the time.

Since those companies have learned to listen to their clients, they might have a good chance to beat the traditional OEMs onto their own battleground.

Conclusions

As you’ve learned by reading the “Mobility in 2050”-triptych, we’re indeed living a pivotal moment in history at which the future of mobility is taking shape! There is a very intriguing and inspiring future ahead of us. It’s up to us to move forward and embrace the upcoming opportunities!

Jacques De Kegel, ir.

Ninove, 2021-02-05

ILLUSTRATIONS

Fig. 1 Overview of the vehicle mix in Belgium (Source: Febiac) and Forecast for an evolution towards a full MaaS and ADEM based mobility model.

Fig. 2 Overview of the vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards a full MaaS and 100 % ADEM based mobility model by 2060

Fig. 3 Overview of the B2C vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards a full MaaS and 100 % ADEM based mobility model by 2060.

Fig. 4 Screen shot from article on Nio’s efforts to accelerate development of the next-gen battery swap station.

Fig. 5 Forecast on the evolution of the B2C vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060.

Fig. 6 Overview of the B2B-1 vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards fully Electrified by 2050 and 100 % ADEM by 2060

Fig. 7 Forecast on the evolution of the B2B-1 vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060.

Fig. 8 Overview of the B2B-2 vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards fully Electrified by 2050 and 100 % ADEM by 2060.

Fig. 9 Forecast on the evolution of the B2B-2 vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060

Fig. 10 A Heavy Utility Vehicle, transformed to contain up to 8 30 KWh swappable batteries, thus giving it an autonomy of about 240 km after a full swap. Courtesy: DAF Trucks

Fig. 11 Overview of the B2B-3 vehicle mix in Belgium in 2020 (Source: Febiac) and Forecast for an evolution towards fully Electrified by 2050 and 100 % ADEM by 2060.

Fig. 12 Forecast on the evolution of the B2B-3 vehicle mix in Belgium towards a 100 % Electric fleet by 2050 and 100 % ADEM based mobility model by 2060

ACRONYMS

MaaS Mobility as a Service

BaaS Battery as a Service

ADEM Autonomous Driving Electric Mobility

BEV Battery Electric Vehicle

ICE Internal Combustion Engine

PDC Person-Driven Car

S2E Swap2drivE, a patented battery swap solution

B2C Business to Consumer

B2B Business to Business

CC Conductive Charging (= charging at an energy pole with a cable)

BRS Battery Recharging Station

NOTES

(1) Figures, coming from the Febiac Annual Report 2020 http://www.febiac.be/documents_febiac/publications/2020/JAARVERSLAG-FEBIAC-2020_NL.pdf

(2) Figures, coming from ACEA Report “Vehicles in Use in Europe” – January 2021 https://www.acea.be/uploads/publications/report-vehicles-in-use-europe-january-2021.pdf

(3) Website of the US Energy Department about the History of the Electric Car https://www.energy.gov/articles/history-electric-car

(4) China’s Battery Swap Trend is Way Ahead https://guidehouseinsights.com/news-and-views/chinas-battery-swap-trend-is-way-ahead

(5) EV 2.0 Electrical Vehicle: Friend or Foe of Smart Grids? – ir. Jacques De Kegel https://www.linkedin.com/in/jacques-de-kegel

(6) Would you buy an EV from Sony? https://www.autoweek.com/news/green-cars/a35226640/would-you-buy-an-ev-from-sony/

HASHTAGS

#futureofmobility #automotive #innovation #sustainability #technology #mobility #elektrischrijden #electromobility #fitfor55

Freelance Mobility Consultant and Fin-Tech Entrepreneur

3yThe battery swat believers in action 👍