Amid Rising Inflation, 61% of Americans Who Paid a Bill Late in the Past 6 Months Say They Couldn’t Afford It

Many Americans are feeling financially squeezed as the cost of living rises, and having a thinner wallet can come with consequences when it’s time to pay bills. In fact, 32% of Americans have paid a bill late in the past six months — and 61% of them say it’s because they didn’t have enough money to cover the costs.

The newest LendingTree survey asks nearly 1,600 U.S. consumers about their bill-paying habits. In addition to going over why Americans are paying their bills late and which bills they’re missing, we’ll discuss the rate of consumers who say they’re less able to afford their bills amid rising inflation.

On this page

- Key findings

- Americans late on bills say they didn’t have enough money

- Utility, credit card bills most likely to be paid late

- 40% of Americans struggle to afford their monthly bills compared to last year

- More than half of Americans have overdrafted accounts to pay bills

- Expert tips for paying your bills on time

- Methodology

Key findings

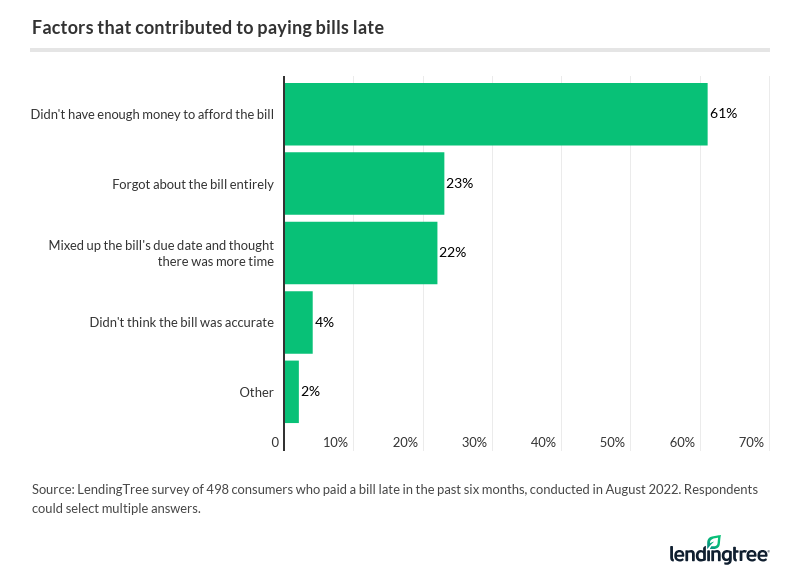

- 61% of Americans who’ve paid a bill late in the past six months say they didn’t have enough money to cover the cost. Women are more likely than men to cite this — 64% versus 57%. Nearly 1 in 4 (23%) of those who recently paid late say they forgot their bill entirely, while 22% say they mixed up due dates.

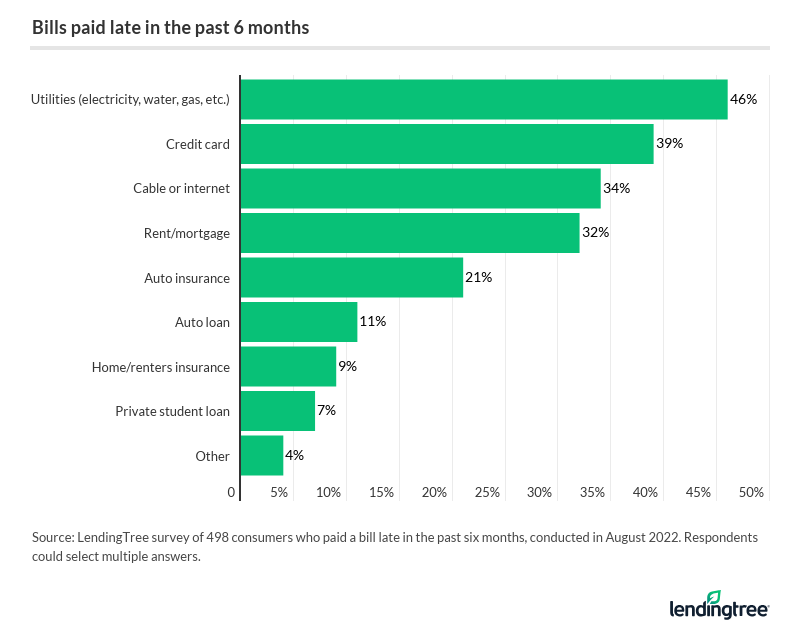

- Nearly half of those who were recently late with a payment say it was a utility bill (46%), followed by a credit card (39%) or cable or internet bill (34%). Women cite utility bills as the main culprit (51%), while men say it’s credit card debt (42%).

- 40% of Americans say they’re less able to afford their bills than a year ago. Those who make less than $35,000 a year are the only demographic in which more than half (54%) cite this. Overall, 62% of Americans struggle to afford at least one bill.

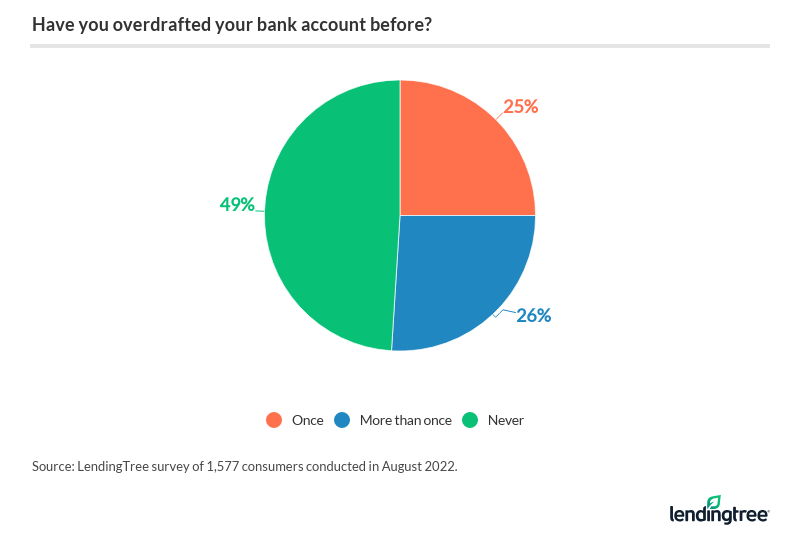

- 51% of Americans have overdrafted their account to pay a bill, with 26% saying they’ve done it more than once. Of people who paid their bill late in the past six months, 72% say their primary bank charges overdraft fees, while another 8% don’t know.

Americans late on bills say they didn’t have enough money

Most Americans are no stranger to late payments, as 64% have paid a bill late before. For half of those Americans (32%), these late payments happened in the past six months.

Rising inflation may be to blame, as 61% of consumers who’ve recently paid a bill late say it’s because they didn’t have enough money to cover the costs. That makes it the most common reason for late payments. By gender, women (64%) are more likely to say they’re short on cash for bills than men (57%).

LendingTree chief credit analyst Matt Schulz says not everyone has been able to make ends meet, even as many Americans are likely trimming their budgets to pay their bills.

In addition, 23% of those who’ve paid late in the past six months say they forgot their bill entirely, while 22% say they mixed up due dates.

Meanwhile, 36% of Americans have never paid a bill late. Some demographic groups may be more fortunate than others. Baby boomers ages 57 to 76, in particular, are the most likely to have never paid a bill late, with almost half (48%) reporting consistent on-time payments. On the other hand, that figure for Gen Xers ages 18 to 25 is just 27% — making them the least likely age group to say they’ve never paid a bill late.

By income, 43% of those who earn $75,000 to $99,999 a year and 41% of six-figure earners haven’t paid a bill late. That’s a stark difference from the lowest-earning cohort. Of those with annual household incomes below $35,000, only 28% have never missed a bill.

Utility, credit card bills most likely to be paid late

Conserving energy isn’t only good for the environment. It’s also good for your pockets, particularly if you’re struggling to pay your bills on time. Nearly half (46%) of those who’ve missed a payment in the past six months say it was a utility bill — the most of any category.

Following that, credit cards (39%) and cable or internet bills (34%) are the most common ones that consumers have missed.

By gender, however, the type of missed bill varies. Women are most likely to cite utility bills as the main culprit (51%), while men are more likely to say it’s credit card debt (42%).

40% of Americans struggle to afford their monthly bills compared to last year

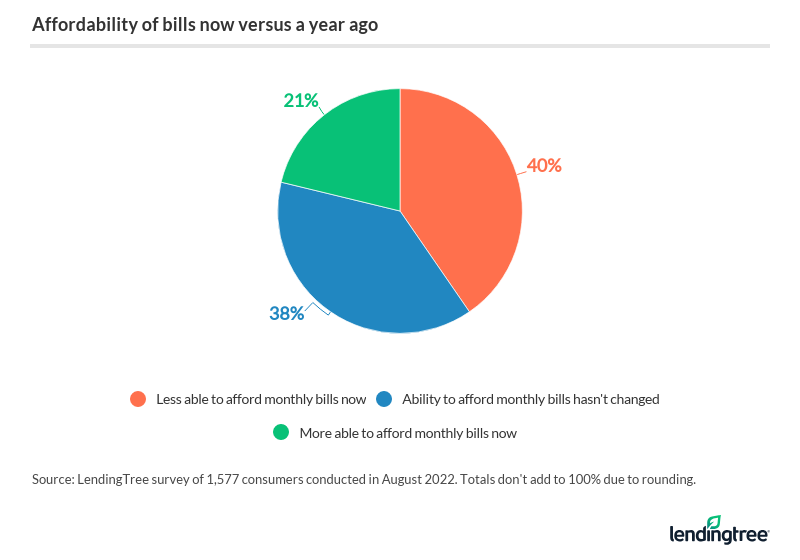

Late payments aren’t the only impact inflation has had on Americans. In fact, 4 in 10 (40%) consumers say they’re less able to afford their monthly bills than a year ago. That’s slightly more than the 38% who say their ability to afford their monthly bills hasn’t changed in the past year.

High earners are generally less likely to feel the impact of rising costs on their ability to pay their bills. In fact, 50% of six-figure earners say their ability to afford their monthly bills hasn’t changed in the past year. On the other hand, more than half (54%) of those with a household income of less than $35,000 are less able to afford their monthly bills now than a year ago — the only demographic over 50%. That’s followed by 42% of those with a household income between $35,000 and $49,999.

Additionally, women (46%) are more likely than men (33%) to say they’re less able to afford their monthly bills now than a year ago.

Meanwhile, just 21% of Americans say they’re more able to afford their monthly bills now than a year ago, though that percentage is highest among Gen Zers (35%) and six-figure earners (30%). Baby boomers, on the other hand, are the most likely to say their ability to afford their monthly bills hasn’t changed in the past year, at 51%.

Americans struggle to afford housing costs the most

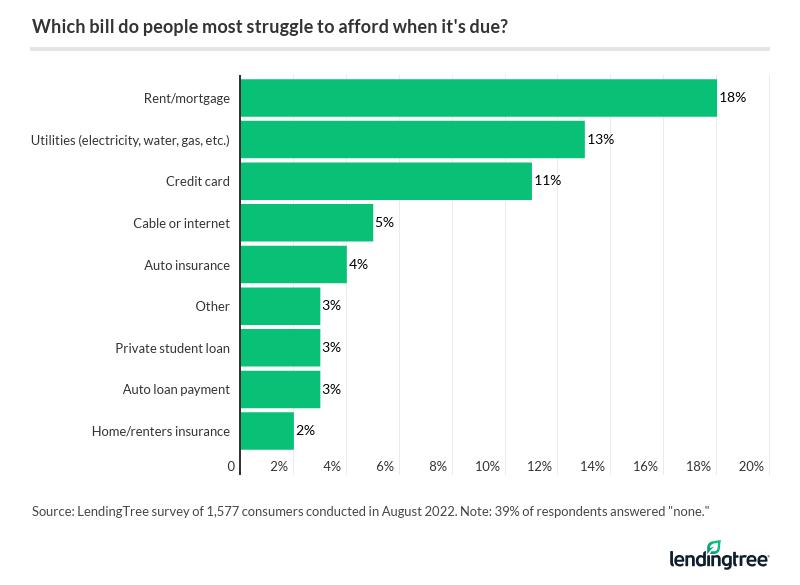

Still, most (62%) Americans struggle to afford at least one bill. By age group, Gen Xers ages 42 to 56 are the most likely to struggle with at least one bill (69%), though millennials ages 26 to 41 aren’t far behind (68%).

By bill type, Americans struggle to afford their housing costs the most. Overall, 18% struggle to pay their rent or mortgage, while 13% struggle to pay their utilities. Beyond housing and utility costs, credit cards are the next most common bills consumers wrestle with (11%).

Meanwhile, 39% of people say they don’t struggle to afford any of their bills, with men (41%) more likely to say so than women (36%).

More than half of Americans have overdrafted accounts to pay bills

Amid a widespread struggle to pay bills, more than half (51%) of Americans have overdrafted their accounts to do so. What’s more, over a quarter (26%) have overdrafted their accounts more than once.

Millennials (58%), Gen Xers (56%), Gen Zers (55%) and those with household incomes below $35,000 (54%) are the most likely to have overdrafted their bank accounts to pay a bill at least once. Meanwhile, baby boomers (67%) and six-figure earners (53%) are the most likely to have never overdrafted their bank accounts while paying the bills.

When it comes to the consequences of overdrafting an account, most of those who’ve recently dealt with a late bill know what extra fees they’d be paying. Of those who paid a late bill in the past six months, 72% say their primary bank charges overdraft fees. However, another 8% don’t know.

Most Americans use a mix of auto-draft and manual payments — here’s why

Of course, consumers may be overdrafting their accounts because they’re auto-drafting their bills. Overall, the majority (63%) of Americans use at least some form of auto-drafting. Broken down further, 40% of Americans use a mix of auto-draft and manual methods to pay their bills, while 23% auto-draft all bills from their accounts. That leaves 37% who pay all their bills manually.

While Schulz believes auto-drafting can be helpful, he warns that it isn’t a perfect system.

Those with annual household incomes of $75,000 to $99,999 are the most likely to have all their bills auto-drafted from their account (35%). By age, Gen Zers (32%) and millennials (26%) are more likely to auto-draft all their bills. Meanwhile, men are more likely to have all their bills auto-drafted from their accounts than women (27% versus 19%).

Of those who pay at least one bill manually, 40% say they do so to have control over the payment date, making it the top reason for making a manual payment. That’s followed by being able to review charges first (37%) and making sure the payment went through (35%).

Expert tips for paying your bills on time

While late bill payments happen occasionally, the consequences can add up. If you find yourself digging a deeper debt hole, Schulz offers the following advice to catch up on payments again:

- A budget is crucial. “You can’t make a meaningful plan to manage your finances if you don’t know exactly how much money is going in and out of your household each month, so everything has to start there,” Schulz says. “Once you’ve nailed that down, you can put together a budget plan that aligns with your priorities. That may mean eliminating some things to free up more cash to pay the bills, knock down debt or build an emergency fund, but tough times require tough choices. A budget won’t make that decision for you, but it can help you more clearly see what your options might be.”

- Build an emergency fund. “Even if it means that it’ll take you longer to pay down your credit card debt, it’s still worth putting money away for a rainy day, if at all possible,” Schulz says. “That’s the best way to stop the cycle of debt. If you pay off your credit card debt and have no savings, the next unexpected expense will have to go back on your credit card and you’ll be right back in debt. An emergency fund helps you avoid that.”

- Take care of your mental and physical health. “There’s little that’s more stressful than wondering how you’re going to make ends meet,” Schulz says. “It consumes your life and all the worry can take a real toll on your health, leading to unexpected doctors’ visits and ultimately more debt. By doing what you can within your budget to prioritize your mental and physical health, you’ll be better able to manage the stresses of everyday life, make better decisions and ultimately keep some costs down just by feeling better.” As you start paying off your debts, it’s also important to know how to prioritize your bills and ensure your basic needs — like food, shelter, transportation, heat and water — are covered.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,577 U.S. consumers ages 18 to 76 from Aug. 19 to 26, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76