Local audit framework: technical consultation

Updated 31 May 2022

Applies to England

1. Scope of the consultation

Topic of this consultation

The local audit framework.

Scope of this consultation

The Ministry of Housing, Communities and Local Government is consulting on the following proposals as part of the government’s response to the Redmond Review:

- A new system leader for the local audit framework.

- Proposals to strengthen audit committee arrangements within councils.

- Measures to address ongoing capacity issues on the pipeline of local auditors.

- Action to further consider local audit functions for smaller bodies.

Local bodies:

- county councils

- district councils

- London borough councils

- unitary authorities

- metropolitan councils

- local police bodies

- fire and rescue authorities

- combined authorities (covering elected regional mayors), national park authorities

- conservation boards

- passenger transport executives

- waste authorities

- functional bodies and other specified bodies

- smaller authorities

- Clinical Commissioning Groups

- Health Trusts

- Foundation Trusts

Geographical scope

The questions in this consultation paper apply to local government bodies in England, as defined above.

Impact assessment

We will produce a full Public Sector Equality Duty (PSED) assessment as the policy proposals develop further following this consultation.

2. Basic information

This is an open consultation. We particularly seek the views of individual members of the public; prospective and current elected members/representatives; all relevant local bodies defined above and other organisations which form part of the local audit framework, such as audit companies.

Body/bodies responsible for the consultation

The Local Government Stewardship Division in the Ministry of Housing, Communities and Local Government is responsible for conducting this consultation.

Duration

This consultation will last for 8 weeks from 28 July 2021.

Enquiries

For any enquiries about the consultation please contact: localaudit@communities.gov.uk.

How to respond

You can respond to this call for evidence through our online consultation platform, Citizen Space.

3. Introduction

1. Transparent local authority financial reporting and a robust system of local audit are key to sustaining public confidence in our systems of local democracy. The independent audit of a local authority’s statutory accounts and arrangements for achieving value for money are a key transparency and accountability mechanism, enabling taxpayers to have confidence that their local authority’s financial accounts are true and fair and providing assurance that the authority has been acting with propriety and has arrangements in place to secure value for money through the economic, efficient and effective use of its resources.

2. MHCLG holds Accounting Officer responsibility for the core local government accountability framework for local authorities, of which local audit is a key element, and this consultation follows the department’s Spring Report on the government’s response to Local Authority financial reporting and external audit, delivered to the Secretary of State by Sir Tony Redmond on 8 September 2020. Sir Tony was commissioned by this department in July 2019 to undertake an independent review into the arrangements in place to support the transparency and quality of local authority financial reporting and external audit. The government provided an initial response to the Redmond Review on 17 December 2020.

3. The Spring Report updated on immediate actions taken in response to the 23 recommendations Sir Tony made and provided a full response to Sir Tony’s recommendations on system leadership, setting out our intention that the Audit Reporting and Governance Authority (ARGA), the new regulator being established to replace the Financial Reporting Council (FRC), should assume the role of system leader for local audit.

4. This consultation document seeks views on our broad implementation proposals and also responds to the recent consultations on the appropriate methodology for distributing £15 million to support affected local bodies, as well as changes to the appointing person fee setting regulations to provide Public Sector Audit Appointments Ltd (PSAA) with additional flexibilities.

5. In March 2021 the white paper Restoring trust in audit and corporate governance was published, with a public consultation which closed on 8 July. The white paper sets out the government’s broader reforms to transparency and governance for statutory audit, including the establishment of a new regulator for statutory audit, which are referenced in this consultation.

4. Further action to support market stability

6. The timely completion of audits is vital in maintaining the transparency and assurance of local authority accounts. Late delivery of local assurance can have a significant impact not just on local authority financial planning but also on the timely completion of Whole Government Accounts.

7. In our response to the Redmond Review, we committed to take action to help improve the timeliness of auditor reporting and to support the stability of the local audit market.

8. In March 2021 we amended the Accounts and Audit regulations to extend the publication deadline for audited local authority accounts from 31 July to 30 September for 2 years up to the 2021/22 financial year. At the end of this period, we will review whether there is a continued need to have an extended deadline.

9. In our December (2019) response, we announced that we would provide £15 million to principal bodies, both to help support affected bodies to meet the anticipated increase in audit fee costs in 21/22 and to support with new burdens relating to implementing Redmond’s recommendations.

10. To gather views from stakeholders on the most equitable way to allocate this funding, we ran an open consultation from 20 April to 18 May 2021. The majority of respondents to the consultation agreed with our proposal to use a methodology that based individual allocations on each body’s scale fee as a proportion of the total fee scale that each body currently pays as part of the current contracts. We have now published our response. Payments will be made to local bodies in due course.

11. The government also committed to consult on proposals to provide the appointing person (PSAA, the bulk audit services procurement body) with greater flexibility to ensure the costs to audit firms of additional work are met and to reduce the need for time consuming case by case consideration of fee variation requests. Therefore, we ran a consultation from 20 April to 1 June 2021. The majority of respondents agreed with our proposals to:

- extend the regulatory deadline by which scale fees need to be set to enable the appointing person to take into account more up-to-date information;

- enable the appointing person to consult and agree standardised fee variations to be applied to all or certain groups of principal bodies;

- provide clarification on enabling some fee variations for additional elements of work to be approved during the audit; and

- expressly enable the appointing person to appoint auditors for the period that it considers to be the most appropriate, up to the maximum length of the appointing period subject to consultation with the relevant bodies.

12. We have also published our response to the consultation, where we commit to introducing secondary legislation to amend the Local Audit (Appointing Person) Regulations 2015, with the aim for updated regulations to come into force in the autumn.

13. We are confident that the above measures will help to strengthen the stability of the local audit market and address some of the factors that can result in issues with timeliness.

5. System leadership

14. MHCLG’s priorities for local audit are a strong and coordinated quality framework, a buoyant local audit market, and improved transparency and governance.

15. The Local Audit and Accountability Act 2014 created a locally-led audit regime which delivered a range of benefits. The cost to local authorities and government of local audit reduced considerably, with savings estimated to reach £1.35 billion over 10 years.

16. The Act also gave local bodies greater flexibility over the procurement of their audit services and required principle councils to publish certain information set out in transparency codes which, for the very smallest authorities, replaced external audit in most cases. This department remains committed to the principles of a locally-led audit regime, as embodied in the 2014 Act.

17. The Redmond Review identified a lack of coherence and join up across the current local audit framework, as none of the organisations in the system “had a statutory responsibility, either to act as a systems leader or to make sure that the framework operates in a joined-up and coherent manner”.

18. In our Spring Report we agreed the need for a clearly accountable system leader, with overarching responsibility for the local audit framework, including the Code of Audit Practice and the monitoring and review of local audit performance.

19. We explained our preference that the local audit system leader should be appointed from within the current local audit framework, then set out our view that the Audit Reporting and Governance Authority (ARGA), the new regulator being established to replace the Financial Reporting Council, (FRC), would be best placed to act as system leader for local audit.

ARGA as system leader

20. The government announced its plan to establish ARGA in the white paper Restoring trust in audit and corporate governance, published in March 2021, which also sets out broader reforms to transparency and governance for statutory audit and plans to encourage competition in the market for audit of large listed companies.

21. We think ARGA is best placed to take on the system leader role because in the current local audit framework the FRC is the only organisation which undertakes the core functions in relation to the quality framework we think a system leader needs to have, as well as being an existing regulator.

22. We also think local audit should remain within the broader audit landscape, so the benefits of the Local Audit and Accountability Act 2014 can be maintained and the broader reforms the government is making to transparency and governance within corporate audit can be harnessed for local audit.

23. Finally, there are clear interdependencies between local government and health audit. The government’s NHS white paper Working together to improve health and social care for all is driving greater integration between health and local government services, so it is a priority for us that the current alignment between local government audit and health audit should be maintained. Appointing ARGA as system leader enables that and would further allow for ARGA to also act as system leader for health audit, subject to agreement on that proposal.

What is meant by system leadership?

24. As we consider a system leader for local audit, it is important to define what we mean by ‘system leadership’, a term often used to describe how individuals and organisations can work across traditional organisational boundaries to ensure a more joined-up approach.

25. The functions within the existing local audit framework are currently delivered by the Financial Reporting Council, (FRC), the Institute of Chartered Accountants for England and Wales, (ICAEW), the National Audit Office, (NAO), Public Sector Audit Appointments Ltd (PSAA) and Smaller Authorities Audit Appointments Ltd (SAAA), alongside the Chartered Institute of Public Finance and Accountancy’s (CIPFA) code of practice on local authority accounting.

26. While these organisations have consistently sought to engage proactively to resolve emerging issues, each is bound by its own organisational objectives, which can fail to ‘join up’ or may even conflict. In this way, a lack of leadership across the system has hampered both a coherent response to challenges arising and a nimble response to changing imperatives.

27. Consequently, it is important that a system leader for local audit should fulfil the following functions: It should have responsibility for ensuring coordination across different parties and for responding to strategic priorities. It should also be able to identify risks and issues as they emerge, with the power to act on these, or oversee action by others, as well as considering potential trade-offs in the round.

28. While MHCLG will retain Accounting Officer responsibilities for the core local government accountability framework for local authorities, including local audit policy, the system leader will also perform an important role in informing the broader accountability framework for local government, by identifying emerging themes facing local bodies, including through the annual report.

29. Finally, we think the system leader for local audit should have statutory responsibilities and powers to ensure that they are able to function appropriately.

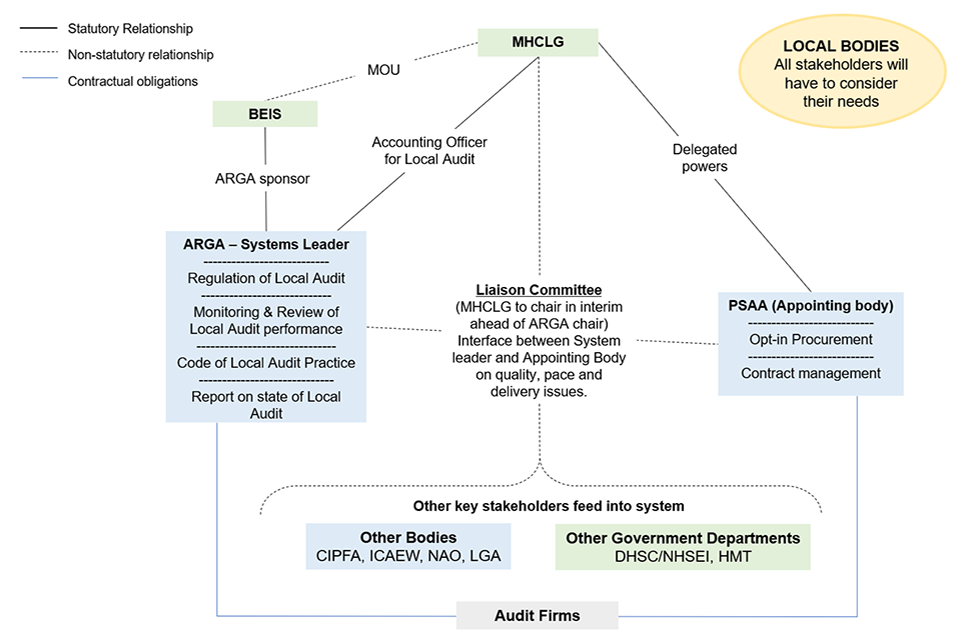

Figure 1: New Local Audit Framework

Question 1: Do you agree with the proposed functions which the system leader for local audit needs to enable a joined-up response to challenges and emerging priorities across local audit? Please let us know any comments you have on the proposal.

ARGA’s responsibilities as system leader

30. The FRC is currently the regulator for local audit within its broader role as regulator for all statutory audit, and is delegated specific functions, including oversight of the regulation of auditors of local public bodies by Registered Supervisory Bodies, and the oversight and monitoring for audits of significant local public bodies. The full details of these current responsibilities related to local audit are described on the FRC’s website, and the intention is that ARGA will continue to fulfil these once it is established.

31. In addition to this, ARGA would have overarching responsibility for the local audit framework, by taking on statutory responsibility for the Code of Audit Practice and associated Auditor Guidance Notes that are currently prepared and issued by the NAO, alongside the monitoring and review of local audit performance, although elements of this may continue to be delivered by other organisations, (for example, quality reviews of local authority audits by ICAEW).

32. As well as preparing and issuing the Code of Audit Practice, the NAO currently also undertakes a number of other activities that contribute to the delivery of its statutory functions relating to local audit, including running and participating in networks with local audit firms related to local government and NHS accounts and value for money and pension issues. The NAO also operates contracts with expert advisors to assist with Code setting responsibilities and to support local auditors, covering legal matters, pensions and property valuations. We would welcome views on whether these activities should be continued.

Question 2: Do you have any comments on the proposed functions that ARGA should have alongside its new system leader responsibilities?

33. As outlined in the Spring Report, to avoid conflicts of interest with its regulatory and quality oversight functions, ARGA will not conduct procurement or contract management – these will continue to be delivered by a separate Appointing Body (see Appointing Body section below for further detail).

Code of Audit Practice

34. The Code of Audit Practice has the status of secondary legislation and the Local Audit and Accountability Act 2014 requires it to be updated at least every 5 years, with the latest version of the Code published in April 2020.

35. The government’s view is that the scope of local audit should reach further than for company audits, in recognition that unlike shareholders, taxpayers cannot divest from their local bodies.

36. Therefore, in addition to offering an opinion that the statutory financial accounts, produced in accordance with CIPFA’s Code of Practice on Local Authority Accounting, are true and fair, the Local Audit and Accountability Act 2014 also requires a further ‘Value for Money arrangements’ element for public audit.

37. This includes an assessment on whether the auditor is satisfied that the local body has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources, including consideration of financial sustainability and governance arrangements.

38. In undertaking the value for money arrangements audit, the auditor is required to review whether proper practices were in place, rather than form a view on whether a local authority/body has delivered value for money.

39. Until recently, the Code required auditors to discharge their duty under the LAAA 2014 through giving an opinion on whether the proper arrangements were in place. However, this was revised in the recent update to the Code, with auditors now required to provide a narrative commentary on the arrangements in place.

40. As the transfer of responsibility for the Code of Audit Practice will require primary legislation, the NAO will continue to hold responsibility for managing the Code until ARGA is established. Therefore, we propose that, following the completion of the first set of audits under the updated code (relating to the 2020/2021 financial year), the NAO conduct an initial technical review of the new value for money narrative requirement, so any immediate problems arising can be addressed.

41. In order to assess whether the new value for money narrative requirement has led to more effective external audit consideration of financial resilience and value for money matters, a full post-implementation review of the new requirement will then need to be conducted. We propose this review should be conducted 2 years after its introduction, and help to inform the development of the next Code.

Question 3: Do you agree that the system leader should conduct a full post implementation review to assess whether changes to the Code of Audit Practice have led to more effective external audit consideration of financial resilience and value for money matters 2 years after its introduction, with an immediate technical review to be conducted by the NAO? Please let us know any comments you have on the proposal.

Expertise and focus

42. To ensure that the new regulator ARGA acquires the detailed expertise and clear focus on the local audit sector which we think the system leader for local audit needs to have, a dedicated unit within ARGA will assume responsibility for local audit related work, including oversight and inspection.

43. Furthermore, to ensure the government has the information it needs to shape the regulatory framework according to ARGA’s experience on the ground, ARGA will set up effective engagement networks with local bodies and audit firms. As outlined in the section on interim arrangements further down, these will be established in shadow form from April 2022.

Question 4: Do you agree with the proposals to ensure that ARGA has sufficient expertise and focus on local audit? Please let us know any comments you have on the proposals.

Liaison Committee

44. We set out our view in our Spring Report that ARGA should also act as chair of the Liaison Committee, the senior committee of senior stakeholders which Sir Tony Redmond had recommended should be established. The exact membership of this will be subject to further consideration, but we envisage representation from organisations including CIPFA, PSAA, LGA, NAO, ICAEW, MHCLG, the Department of Health and Social Care (DHSC), NHS England, BEIS and HM Treasury (HMT).

45. The Liaison Committee will be the key forum for ensuring coordination across different parties, but also for acting on risks and issues as they emerge and considering responses to developments in local audit. For example, ensuring that there is alignment between the objectives of the Appointing Body responsible for procurement and contract management and the wider system.

46. The Liaison Committee will meet quarterly and will be chaired by MHCLG as part of interim arrangements ahead of ARGA’s establishment.

Question 5: Do you agree with the proposed role and scope of the Liaison Committee? Please let us know any comments you have on the proposal.

Question 6: Do you agree that the responsibilities set out above will enable ARGA to act as an effective system leader for local audit? Are there any other functions you think the system leader for local audit should have?

Statutory objectives and functions for system leader for local audit

47. To function effectively, the system leader for local audit will need statutory responsibilities and powers. Government has been consulting on statutory objectives, functions and regulatory principles for ARGA through the white paper Restoring trust in audit and corporate governance, published in March 2021. This consultation closed on 8 July.

Overarching proposed ARGA objectives

General objective: To protect and promote the interests of investors, other users of corporate reporting and the wider public interest.

Quality objective: To promote high quality audit, corporate reporting, corporate governance, accounting and actuarial work.

Competition objective: To promote effective competition in the market for statutory audit work.

48. We do not propose to amend any of objectives and functions already consulted on, which cover the broader statutory framework for audit of which local audit forms a part.

49. To reflect the additional responsibilities relating to system leadership we are proposing an additional statutory objective setting out ARGA’s role as system leader:

System leader for local audit objective: to ensure the local audit system operates effectively.

This would include ensuring alignment of different functions within the framework and coordinating between different interested parties to determine and act on emerging priorities, risks and issues.

50. As the regulator for all statutory audit, the white paper also proposes that ARGA will be required to have regard to a series of regulatory principles.

51. In order to reflect the specific requirements of the local audit, we propose that ARGA should also have a responsibility for the value for money arrangements in local audit:

For local audit, also having regard to the requirement of the Local Audit and Accountability Act 2014 that an audit of a relevant authority (referred to in the Act as ‘local audit’) includes a value for money arrangements commentary.

Question 7: What is your view on the proposed statutory objective for ARGA to act as system leader for local audit? Please include any comments on the proposed wording.

Question 8: Do you agree with the proposal that ARGA will have a responsibility to give regard to the value for money considerations set out in the Local Audit and Accountability Act 2014? Please include any comments on the proposed wording.

Governance of ARGA as system leader

52. Broad governance and accountability mechanisms for ARGA have been subject to consultation in the White Paper Restoring Public Trust and confidence. These include the issuing of a Remit letter by the Secretary of State for Business, Energy and Industrial Strategy at least once every Parliament, the production of an annual report and recommendations on leadership and board membership for the new regulator.

53. MHCLG’s Secretary of State will retain Accounting Officer responsibility for policy relating to the audit of local bodies and this will be reflected in clear lines of accountability for ARGA’s statutory responsibilities as system leader for local audit.

54. Memoranda of Understanding between respective Secretaries of State will set out departmental lines of accountability for ARGA’s role as system leader for local audit.

Remit letter

55. As set out above, it is proposed that a Remit letter from the Secretary of State for Business, Energy and Industrial Strategy should be sent to ARGA at least once a Parliament setting out the strategic priorities the regulator should consider when exercising its policy making functions. The Remit letter will be published and laid before Parliament. It is also proposed that the regulator should in turn have a duty to respond publicly to that letter, explaining what they propose to do in consequence of it.

56. The Remit letter will complement the regulator’s statutory objectives and seek to ensure that the regulator has regard to the government’s overarching policy aims when carrying out its policy-making functions without compromising its operational and regulatory independence.

57. We propose that discrete Remit letters from MHCLG’s Secretary of State should be used to set out the strategic priorities the regulator should have regard to in exercise of its local audit system leader function, with the same requirement for response by the regulator. There is also potential to use this mechanism by exception where extraordinary developments (e.g. COVID-19) require. While the government’s corporate audit white paper indicated that these would be at least once a Parliament, in practice they may be more frequent initially while new arrangements bed in.

Question 9: Do you agree that the proposals outlined above will provide an appropriate governance mechanism to ensure that the new system leader has appropriate regard to the government’s overarching policy aims without compromising its operational and regulatory independence? Please let us know any comments you have on the proposal.

Annual report

58. As set out above, ARGA will be required to deliver an annual report to Parliament on delivery against its objectives. The annual report will expand on the annual report the FRC currently produces on its activities relating to the oversight of statutory auditors, to include reporting on the new regulator’s broader regulatory activities, including performance of the regulator’s enforcement function, to enable greater parliamentary scrutiny of the regulator’s work and performance.

59. Sir Tony Redmond recommended that the system leader for local audit should have responsibility for producing annual reports summarising the state of local audit. We strongly agree with this recommendation as no entity currently has the responsibility to collate and report on the results of the work of the external auditors of local authorities and individual NHS bodies.

60. Accordingly, we propose that ARGA’s statutory function as local audit system leader will form a distinct, standing element of ARGA’s annual reporting, potentially as a separate annex to the main annual report which ARGA produces.

61. We note that when PSAA was previously required to produce an annual Report on the results of auditors’ work for Principal local government and police bodies, this included detail on the number of audits completed by the statutory deadline and the number of qualified financial audit and value for money opinions, with the latter categorised by theme. It also listed all Public Interest Reports, Statutory Recommendations and Advisory Notices issued in the preceding year. It did not include any details on risks raised by auditors in their Audit Planning Reports or non-statutory recommendations made to local authorities.

62. In addition to reporting against its own system leader objective we see this as an important mechanism for ARGA to report to MHCLG on the state of the local audit market, as well as to inform MHCLG’s stewardship of the local government accountability framework. This could include detail summarising the results of audits, similarly to PSAA’s previous reporting, as well as identifying emerging themes and issues facing local bodies.

Question 10: Do you agree that ARGA’s annual reporting should include detail both on the state of the local audit market, and ARGA’s related activities, but also summarising the results of audits? Please include any views on other things you think this should include.

Board membership

63. The white paper has consulted on a number of FRC Review recommendations relating to role and membership of the board of the new regulator. These include that board members should have diverse skills, experience, and knowledge to provide appropriate scrutiny and challenge to the executive team, the board’s membership should be refreshed with members equipped with the necessary leadership skills to deliver the regulator’s expanded remit and the board should be smaller in size than the current FRC board.

64. It is also proposed that board appointments should be made by Secretary of State for Business, Energy and Industrial Strategy, subject to an open and fair recruitment process.

65. With regard to ARGA’s role as system leader for local audit, and the need for accountability to both government and Parliament, there will need to be a nominated board member with responsibilities for local audit. BEIS will liaise with MHCLG on the criteria for board appointments to ensure that these reflect the needs of local audit.

Question 11: Do you agree with the proposal outlined above relating to board responsibility for local audit? Please let us know any comments you have on the proposal.

Funding

66. BEIS’s white paper proposes that ARGA should be funded via a statutory levy, set by the government each year, with funding drawn from audit and accountancy professional bodies and “preparers of accounts”, including companies listed on the London Stock Exchange, large private companies, and public sector organisations.

67. It also sets out that the government and FRC consider it important that the levy is transparent, predictable and sustainable. The levy will be cost reflective and will comply with the requirements of Managing Public Money.

68. We have considered whether these arrangements could equally be applied to the funding requirements relating to local audit, by extending the levy to local bodies and audit firms involved in local audit contracts.

69. However, we are mindful of placing additional costs on local audit firms, given the ongoing fragility of the market, while in practice any additional costs for local bodies would need to be met by new burdens funding from MHCLG. Given this, we are minded that ARGA’s specific local audit responsibilities should be funded directly by MHCLG.

Question 12: Do you agree that ARGA’s local audit functions and responsibilities should be funded directly by MHCLG rather than a statutory levy?

Health audit

70. The proposed new local audit framework will enable continued alignment of local government and health audit. This would include NHS trusts, NHS foundation trusts and Clinical Commissioning Groups; and potentially in the future Integrated Care System NHS bodies, subject to parliamentary approval of the Health and Care Bill.

71. Many of the constraints and objectives set out above apply equally to health audit. Co-ordination of effort between the current functions of the Financial Reporting Council, Institute of Chartered Accountants in England and Wales and the National Audit Office will allow a coherent response to challenges, including actions needed to ensure the sustainability of local audit provision.

72. We would welcome views on whether ARGA should also assume system leader responsibilities for health audit. In this case, the reporting and governance mechanisms we have set out between ARGA and MHCLG for local audit would also apply for health audit.

Question 13: Do you agree that ARGA should also take on system leader responsibilities for health audit? Please let us know any comments you have on the proposal.

Question 14: If you agree that ARGA should assume system leader responsibilities for health audit, do you think any further measures are required to ensure that there is alignment across the broader system?

Interim period/establishment of shadow arrangements

73. While the proposals outlined above to establish ARGA as the new system leader will address the substance of Sir Tony’s recommendations about the need for greater coordination in the local audit framework, in practice, they will take time to fully implement, particularly those elements, such as the transfer of the Code of Local Audit Practice, which will require primary legislation to implement.

74. Given how pressing some of the issues facing local audit are, the government committed in its Spring Report to take on a greater leadership role in the intervening period. This includes establishing the Liaison Committee on an interim basis until ARGA can take on the system leadership responsibilities. The Department is due to hold the inaugural meeting of the Liaison committee on 29 July.

75. But as well as MHCLG taking on a greater responsibility in this period, the FRC is increasing its local audit operations in advance of ARGA’s establishment, to ensure that there is a smooth transition and that the new system leader is able to hit the ground running.

76. To achieve this, the FRC is planning to establish interim arrangements from April 2022, including the appointment of a lead local audit executive, the formation of the new dedicated local audit department in shadow form, as well as establishing new forums for engaging directly with local bodies and local audit firms.

Procurement arrangements Appointing Person

77. The Local Audit and Accountability Act 2014 specifies that relevant principal authorities have responsibility for the appointment of their own auditors. However, the legislation also permits the Secretary of State for Housing, Communities and Local Government to specify an organisation to act as an appointing person for the bulk procurement of audit services to specific local bodies.

78. In July 2016, the Secretary of State specified Public Sector Audit Appointments Ltd (PSAA) as an appointing person for principal local government bodies for audits from 2018/19, under the provisions of the Local Audit and Accountability Act 2014, and the Local Audit (Appointing Person) Regulations 2015 set out the duties of the appointing person in that respect. Acting in accordance with this role, PSAA is responsible for appointing an auditor and setting scales of fees for relevant principal authorities that have chosen to opt into its national scheme.

79. Smaller Authorities Audit Appointments Ltd (SAAA) is the body specified by the Secretary of State to carry out the same role for smaller authorities, although rather than a voluntary ‘opt in’ system, all smaller bodies are automatically ‘opted in’ to these bulk procurement arrangements unless they choose to opt out.

80. MHCLG’s Spring Report proposed that, while Sir Tony recommended that a new system leader should take on responsibility for procurement, there should be independence between the procurement of audit services and audit quality oversight and monitoring functions.

81. It remains our considered view that PSAA is the organisation best placed to act as the appointing body, including overseeing the next opt-in bulk procurement, due to their strong technical expertise and the proactive work they have done to help identify improvements that can be made to the process. This will also help to provide continuity, given the proximity of the next procurement exercise.

82. However, it is clear that the procurement of local audit contracts is a vital element of the broader framework, and objectives need to be aligned across this system, including through consultation with the FRC and other stakeholders. The Liaison Committee will provide a forum to support this, and it will also be supported by an updated Memorandum of Understanding agreed between PSAA, LGA and MHCLG.

Opt-in arrangements

83. While the 2014 Act gave local bodies the power to appoint their own auditors, the large majority of principal bodies to date (all bar 9) have chosen not to, with 98% of such bodies choosing to opt-in to the appointing person arrangements overseen by PSAA from 2018/19 to 2022/23.

84. PSAA is currently preparing its opt-in offer ahead of the procurement for local audit contracts from 2023/24, and recently consulted with principal bodies on its draft prospectus.

85. There have been some suggestions that some principal bodies would be more likely to struggle to appoint a local auditor if they chose not to opt-in to the PSAA scheme, given the ongoing issues with market fragility and the supply of qualified public auditors.

86. The appointing person ‘opt-in’ arrangements currently only apply to local bodies, with health bodies responsible for appointing their own auditors. We have engaged with colleagues in DHSC and NHS England to discuss whether changes should be made to the procurement arrangements for health audit, but it is our shared view that existing arrangements should remain in place at this stage.

87. We would encourage local bodies to consider their options very carefully when deciding to opt-in or not to PSAA’s scheme, given the aforementioned current market issues, and the importance of having high quality audit in place as part of effective governance and local scrutiny.

Question 15: Do you agree with the government’s proposals for maintaining the existing appointing person and opt-in arrangements for principal bodies but with strengthened governance across the system, including with the new system leader? Please let us know any comments you have on the proposal.

88. As outlined in the Spring Report, the Secretary of State for Housing, Communities and Local Government retains the delegation powers, and MHCLG will continue to keep all arrangements under review in future to ensure that they are delivering quality and value for money for local bodies and taxpayers.

6. Enhancing the functions of local audit and the governance for responding to its findings

89. Sir Tony Redmond also looked at the consideration and management of audit reports by authorities and found that many authorities lacked transparency and accountability from a public perspective in relation to their audit arrangements.

90. For example, he noted that, while there were many good examples, there was a mixed picture in terms of how engaged and informed Audit Committee chairs were, and also that elected members may or may not have relevant skills, expertise or background to fulfil the role of a member of an Audit Committee.

91. He also noted that, while the vast majority of local authorities interviewed were supportive of the principle of appointing independent members, only about 40% of Audit Committees currently have done so. The reported experience of having independent members on Audit Committees was mixed. In some cases, they provided useful challenge, but some authorities reported that the effectiveness of independent members was hampered by their lack of sector specific knowledge.

92. In its December response to the Redmond Recommendations, the department agreed to work with LGA, NAO and CIPFA on the delivery of the recommendations aimed to enhance the functioning of local audit, and the governance for responding to its findings. Since then, the department has established a working group comprised of relevant stakeholder organisations, including CIPFA, LGA, PSAA, MHCLG and the Home Office (as well as the NAO in an observer capacity) to consider how to implement the proposals, and we have outlined plans for this below for consultation.

Recommendation 4: The governance arrangements within local authorities be reviewed by local councils with the purpose of:

- an annual report being submitted to Full Council by the external auditor;

- consideration being given to the appointment of at least one independent member, suitably qualified, to the Audit Committee; and

- formalising the facility for the CEO, Monitoring Officer and Chief Financial Officer (CFO) to meet with the Key Audit Partner at least annually

Recommendation 9: External Audit recognises that Internal Audit work can be a key support in appropriate circumstances where consistent with the Code of Audit Practice

Recommendation 12: The external auditor be required to present an Annual Audit Report to the first Full Council meeting after 30 September irrespective of whether the accounts have been certified; OLAR to decide the framework for this report.

Existing guidance

93. The section below includes the government’s proposals for strengthened guidance in response to Sir Tony’s recommendations. However, in the meantime, local authorities should review the existing structure of their audit committees to consider whether their arrangements support effectiveness. Guidance is already available in the CIPFA Position Statement to support this review and a supporting publication, Audit Committees: Practical Guidance for Local Authorities and Police (2018 Edition) is also available. Key aspects to consider include:

a. Whether the committee is dedicated to the functions of an audit committee and not combined with other responsibilities such as scrutiny?

b. Whether the committee reports directly to full council?

c. Whether the size and make-up of the committee supports its effectiveness?

d. The number and role of the independent member or members and whether new or additional independent members are required. The Department would recommend the inclusion of at least one independent member, but more than one may be helpful.

94. Where the council decides to introduce or increase the number of independent members on the committee, then it should take into account the specific knowledge and expertise required to complement the existing committee members. For example, a knowledge and understanding of the following are desirable on an audit committee: governance, internal audit, risk management financial reporting and external audit.

95. Existing guidance is applicable to all principal local authorities, the audit committees for Police and Crime Commissioners (PCCs) and chief constables in England and Wales, and the audit committees of fire and rescue authorities. In considering the questions below, consultation respondents should consider whether proposals should apply to all local bodies, or whether some proposals should only apply to certain bodies, such as councils.

Strengthened guidance, including potential independent member requirements

96. As outlined above, a working group of relevant stakeholder organisations has been working to consider how to improve the effectiveness of local audit by ensuring that there are arrangements in place so that audit reports and recommendations are effectively considered and acted upon by local authorities.

97. The government has accepted the recommendations of this working group that the commitments made in the government’s response to the Redmond Review should be delivered through the development and production of strengthened guidance to support local authorities to manage their audit committee arrangements. This would be delivered through the production of an updated version of CIPFA’s existing guidance: Audit Committees: Practical Guidance for Local Authorities and Police (2018 Edition), including the following:

- requirement for an effective committee structure, including how the independence and importance of the committee is maintained, and other matters such as size and term of membership.

- the role of independent members to bring additional knowledge and expertise and support to help them play an effective role

- support for ensuring the views of the committee are heard, including interactions with and accountability to Full Council and raising the profile of the committee within the body.

- the importance of reporting to all those charged with governance where there are significant issues identified by the Committee (cross reference to Recommendation 4)

- outlining the core functions of the committee, including good governance, internal and external audit, risk management, value for money, financial reporting and internal control.

- knowledge, expertise and training for committee members, including for both existing and independent members, to ensure they are able to fulfil their functions

- the facility for auditors to meet privately with representatives from the audit committee or council where appropriate.

Question 16: Do you agree with the proposal for strengthened audit committee guidance? Please let us know any comments you have on the proposal.

98. CIPFA guidance makes clear that an Audit Committee is required as part of proper arrangements for governance and financial management. However, as Sir Tony highlighted in his report, it is not a statutory requirement for most types of local authority to have an audit committee.

99. The department is committed to the longer term improvement of audit committee arrangements and delivery of good practice and is considering whether Audit Committees should be made a statutory requirement for all local authorities, or whether a new power should be created so that this guidance could take on the status of statutory guidance.

100. The alternative to this would be that the expectations around ensuring that local bodies have proper arrangements in place are reinforced by the assessment of the local auditor, given the NAO’s new Auditor Guidance Note 03 for the new 2020 Code of Local Audit Practice already makes reference to the Audit Committee. This would potentially allow more flexibility in how the guidance is interpreted, depending on what is appropriate for different councils, while also potentially ensuring it is more consistently and appropriately applied.

Question 17: Do you have any views on whether reliance on auditors to comment and recommend improvement in audit committee arrangements is sufficient, or do you think the Department should take further steps towards making the committee a statutory requirement?

Reporting to Full Council

101. In his report Sir Tony stated that a local body’s public accountability to local taxpayers and service users is best served by having significant matters relating to audit discussed in a transparent and accessible way. Full Council (or Police equivalent) is generally considered more visible to the public than committees/subcommittees and so there is a question as to whether Audit Committees are sufficiently transparent to local taxpayers and service users.

102. The Review found that in practice the auditor tends to present matters to the Audit Committee, which decides if a matter is serious enough to be referred to Full Council. In some cases, the Review highlighted some quite serious matters that had not been passed to Full Council when first presented to the Audit Committee. If this is a widespread practice, there is a risk that many elected members may be unsighted on serious governance or financial resilience issues.

103. In order to address this issue, it is recommended that Accounts and Audit regulations are amended so that Full Council (or Police equivalent) should receive the Auditor’s Annual Report (as defined by NAO Code of Local Audit Practice), accompanied by a report from the Audit Committee with responses to the Auditor’s Annual Report.

104. The Redmond recommendation that Full Council should receive the Auditor’s Annual Report at the first full council after 30 September and that the Audit Committee should also report its responses to the Auditor’s report was considered by the working group. The group recommend that in order to ensure that Audit Committee fulfil its duty in considering the Auditor’s report and its findings, that Full Council receive the Auditor’s report and the Audit Committee’s response to that report at the first Full Council meeting following the Audit Committee that considers the Auditor’s Annual Report.

105. The working group has also noted that, while it should be reinforced that auditors must have appropriate powers and opportunities to meet with the appropriate statutory officers, there was not a similar need for this to be included in the Accounts and Audit Regulations, although this is something that Audit Committees should monitor.

Question 18: Do you agree with the proposals that auditors should be required to present an annual report to Full Council, and that the Audit Committee should also report its responses to the Auditor’s report? Please let us know any comments you have on the proposal.

106. The working group also looked at the recommendation that it was important that external auditors recognise that Internal Audit work can be a key support in appropriate circumstances where consistent with the Code of Audit Practice, given internal auditors can be closer to the business than external audit. The Accounts and Audit Regulations 2015 already require a relevant authority to undertake an effective internal audit taking into account public sector standards, and the department agrees with Sir Tony on the value of internal audit within local government bodies and the importance of operating in accordance with the requirements of the Accounts and Audit Regulations 2015.

107. While there is an existing reference to internal audit reports within Auditor Guidance Note (AGN) 03 to support the VFM arrangements, there is no reference to the work of internal audit in AGN06 Local Government Audit Planning. This is something that we would encourage the NAO to review looking forward.

7. Auditor training and qualifications

108. The Review highlighted evidence of market stress in the supply of appropriately experienced and qualified local authority auditors and suggested several reasons for this, including that there is no longer a public sector organisation that undertakes recruitment and training of audit staff in house, and also that only 1 of the 5 professional accountancy bodies that include external audit in their qualification has a mainly public sector focus (CIPFA).

109. In addition, audit firms highlight that after 2020 the Audit Commission cut back on its recruitment of audit examiners. This means that an increasing number of local authority auditors will not have had the public sector as their main focus whist studying for their accountancy qualification.

110. This shortage of auditors is also reflected to a lesser extent in the private sector, which was noted by Sir Donald Brydon, and his proposals for an audit profession have been included in the BEIS consultation on statutory audit.

111. BEIS’s white paper sets out the expectation that ARGA should have a competition objective: to promote effective competition in the market for statutory audit work, given the need for strong action to address the high concentration of the statutory audit market. It will be important to harness the impact of these broader reforms on improving competition in the local audit market too.

Recommendation 5: All auditors engaged in local audit be provided with the requisite skills and training to audit a local authority irrespective of seniority.

Recommendation 8: Statute be revised so that audit firms with the requisite capacity, skills and experience are not excluded from bidding for local audit work.

112. Sir Tony highlighted in his Review that there is “evidence of market stress in the supply of appropriately experienced and qualified local authority auditors” and recommended that statutes be revised so that audit firms with the requisite capacity, skills and experience are not excluded from bidding for local audit work.

113. In the government’s December report, MHCLG committed to working with stakeholders, including the ICAEW and FRC, to deliver this recommendation and to implement this commitment,

114. Since then, MHCLG has established a working group, with membership including representatives from the FRC, ICAEW, CIPFA, and PSAA (as well as the NAO in an observer capacity), to review the current guidance on entry requirements for Key Audit Partners in local audit and to consider what else is possible to ensure that firms with the capacity, skills and experience are not excluded from bidding on local audit work, and consider whether changes to statute were required.

115. The current legislative framework, through the Local Audit and Accountability Act 2014, and the Local Audit (Delegation of Functions), and Statutory Audit (Delegation of Functions) Order 2014, stipulates that local audits can only be signed off by a Key Audit Partner, registered with the relevant recognised supervisory body for local audit (currently ICAEW).

116. The sub-group is considering the following proposals:

a. Adding alternative routes to becoming a KAP without lowering standards;

i. to ensure that experienced Responsible Individuals (RIs) can be supported by their firms and possible new training support to gain the experience required to become effective KAPs

ii. and consider how the experience requirements for RIs might be mirrored

b. Allowing the local audit Recognised Supervisory Bodies greater discretion in determining the suitability of the experience gained by KAP applicants.

117. Any changes made to the guidance would need to be consulted on and pass through the FRC governance procedures.

118. Alongside these proposals, the working group is also considering proposals to address concerns raised about skills and training and improve the quality of local accounts and audit, including the potential for developing a comprehensive training offer. This could potentially include:

c. Offering additional training and specialist support to strengthen the skills and knowledgebase of the sector. This could support an alternative route for experienced RIs to enter the market for local audit, including via a top up qualification, and foster a greater understanding between the preparers and users of the accounts and the auditors;

d. Offering a technical advisory service to provide advice on difficult areas of judgement particularly regarding quasi-judicial functions and undertake hot and/or cold file reviews to support audit quality.

119. The working group is continuing to develop these proposals, and plans to engage with the wider sector as this is developed further.

Question 19: Do you have any comments on the proposals for amending Key Audit Partner guidance or addressing concerns raised about skills and training?

Question 20: Are there other changes that might be needed to the Local Audit (Auditor Qualifications and Major Local Audit) Regulations 2014 alongside changes to the FRC’s guidance on Key Audit Partners?

Question 21: Are there other changes that we should consider that could help with improving the future pipeline of local auditor supply?

8. Action to further consider the functioning of local audit for smaller bodies

120. The Redmond Review concluded that in general, the audit arrangements for smaller bodies were not subject to the same levels of concern as for principal local bodies, and were generally effective, although some similarities in relation to the expectations gap, knowledge of auditors and fees arrangements were noted. One of the key developments noted in the report was for the recent trend by principal authorities to transfer assets and associated running costs to parish councils.

121. Redmond’s view was that if smaller authorities were to continue to be given more responsibility, or that their spending were to change as a result, meaning that more were likely to approach the £6.5 million threshold, the current accountability arrangements may no longer be appropriate and that the levels of assurance may need to be reviewed. This is especially pertinent as smaller authorities are not currently bound by council tax referendum principles

Recommendation 14: SAAA considers whether the current level of external audit work commissioned for smaller bodies is proportionate to the nature and size of such organisations

Recommendation 15: SAAA and OLAR examine the current arrangements for increasing audit activities and fees if a body’s turnover exceeds £6.5m.

Recommendation 16: SAAA reviews the current arrangements, with auditors, for managing the resource implications for persistent and vexatious complaints against Parish Councils.

Recommendation 23: JPAG be required to review the Annual Governance and Accountability Return (AGAR) prepared by smaller authorities to see if it can be made more transparent to readers. In doing so the following principles should be considered:

-

Whether “Section 2 – the Accounting Statements” should be moved to the first page of the AGAR so that it is more prominent to readers;

-

Whether budgetary information along with the variance between outturn and budget should be included in the Accounting Statements; and

-

Whether the explanation of variances provided by the authority to the auditor should be disclosed in the AGAR as part of the Accounting Statements

122. As detailed in the Spring report, MHCLG committed to working with stakeholders including SAAA and Joint Panel on Accountability and Governance (JPAG) to deliver these recommendations. A working group was established which also included the National Association of Local Councils (NALC), the Society of Local Council Clerks (SLCC) and the Association of Drainage Authorities (ADA) to consider these recommendations and make proposals for delivery where appropriate.

123. In response to recommendation 14, the NAO has updated Auditor Guidance Note (AGN) 02 for 2020-21 review. Variance explanation levels on the accounting statements, currently 15%, will change to variances of 15% or £100k - whichever is the smaller - which should ensure that at higher turnover levels authorities will need to provide explanations for more of the significant variances and movements in their accounts. Auditors will then be able to ask larger authorities for more details where appropriate.

124. For 2021-22 or 2022-23 reviews onwards, NAO is considering requiring auditors of authorities with over £2million annual turnover to undertake more work around considering the adequacy of these authorities’ internal audit arrangements and report and that these authorities have arrangements for ensuring a comprehensive internal audit function.

125. Sir Tony recommended that JPAG be required to review the Annual Governance and Accountability Return (AGAR) prepared by smaller authorities to see if it can be made more transparent to readers.

126. The published AGAR is currently a maximum of 4 pages and set out in the order in which approvals must be completed: an authority should first consider the annual internal audit report, then must approve the annual governance statement (section 1) before then approving the accounting statements (section 2). The final page is the external auditor report and certificate.

127. The working group has suggested that changes to this may result in increased qualifications due to authorities not completing approvals in the correct order required by the Accounts and Audit Regulations 2015, Reg. 6 (4) (a). Consequently, the group has suggested it may be preferable for smaller bodies to publish their budget statements and variance explanations alongside the AGAR. Question 22: Do you have any comments on the proposal to require smaller bodies to publish their budget statements and variance explanations alongside the Annual Governance and Accountability Return to aid transparency for local service users?

128. The £6.5 million threshold figure for smaller authorities is set out in section 6 of the Local Audit and Accountability Act 2014. Recommendation 15 suggests that this be reviewed in light of the budgets and responsibilities of smaller authorities becoming larger over time. Although currently there are only 2 smaller authorities within the SAAA ambit with over £5 million annual turnover this is likely to increase.

129. The current figure of £6.5 million was chosen to align with the level included for companies in the Companies Act 2006. However, this has since been increased to £10.2 million. If a similar increase in threshold was also applied for smaller bodies, 7 current principal bodies would see their audit requirements reduced. Equally, it may be judged that an alternative basis for setting the audit requirements of local bodies might be considered, given the differences between local bodies and private companies.

Question 23: is the current threshold of £6.5 million still right? If you think a different threshold would be more appropriate, please provide evidence to support this.

130. The working group highlighted some instances where a smaller body may receive a spend a large one-off capital grant that takes them over the threshold for 1-2 years before dropping down again. In one instance, this led to an affected body seeing an increase in their audit costs from £3,600 for a limited assurance review to over £40,000 for a full statutory audit.

Question 24: Do you have any comments on the proposal for a requirement for smaller bodies to transfer to the Category 1 authority audit regime only once the threshold has been breached for 3 years in succession?

131. While we would welcome views on both of these changes, in practice they would require primary legislation to implement.

9. List of questions

Question 1: Do you agree with the proposed functions which the system leader for local audit needs to enable a joined-up response to challenges and emerging priorities across local audit? Please let us know any comments you have on the proposal.

Question 2: Do you have any comments on the proposed functions that ARGA should have alongside its new system leader responsibilities?

Question 3: Do you agree that the system leader should conduct a full post implementation review to assess whether changes to the Code of Audit Practice have led to more effective external audit consideration of financial resilience and value for money matters 2 years after its introduction, with an immediate technical review to be conducted by the NAO? Please let us know any comments you have on the proposal.

Question 4: Do you agree with the proposals to ensure that ARGA has sufficient expertise and focus on local audit? Please let us know any comments you have on the proposals.

Question 5: Do you agree with the proposed role and scope of the Liaison Committee? Please let us know any comments you have on the proposal.

Question 6: Do you agree that the responsibilities set out above will enable ARGA to act as an effective system leader for local audit? Are there any other functions you think the system leader for local audit should have?

Question 7: What is your view on the proposed statutory objective for ARGA to act as system leader for local audit? Please include any comments on the proposed wording.

Question 8: Do you agree with the proposal that ARGA will have a responsibility to give regard to the value for money considerations set out in the Local Audit and Accountability Act 2014? Please include any comments on the proposed wording.

Question 9: Do you agree that the proposals outlined above will provide an appropriate governance mechanism to ensure that the new system leader has appropriate regard to the government’s overarching policy aims without compromising its operational and regulatory independence? Please let us know any comments you have on the proposal.

Question 10: Do you agree that ARGA’s annual reporting should include detail both on the state of the local audit market, and ARGA’s related activities, but also summarising the results of audits? Please include any views on other things you think this should include.

Question 11: Do you agree with the proposal outlined above relating to board responsibility for local audit? Please let us know any comments you have on the proposal.

Question 12: Do you agree that ARGA’s local audit functions and responsibilities should be funded directly by MHCLG rather than a statutory levy?

Question 13: Do you agree that ARGA should also take on system leader responsibilities for health audit? Please let us know any comments you have on the proposal.

Question 14: If you agree that ARGA should assume system leader responsibilities for health audit, do you think any further measures are required to ensure that there is alignment across the broader system?

Question 15: Do you agree with the government’s proposals for maintaining the existing appointing person and opt-in arrangements for principal bodies but with strengthened governance across the system, including with the new system leader? Please let us know any comments you have on the proposal.

Question 16: Do you agree with the proposal for strengthened audit committee guidance? Please let us know any comments you have on the proposal.

Question 17: Do you have any views on whether reliance on auditors to comment and recommend improvement in audit committee arrangements is sufficient, or do you think the Department should take further steps towards making the committee a statutory requirement?

Question 18: Do you agree with the proposals that auditors should be required to present an annual report to Full Council, and that the Audit Committee should also report its responses to the Auditor’s report? Please let us know any comments you have on the proposal.

Question 19: Do you have any comments on the proposals for amending Key Audit Partner guidance or addressing concerns raised about skills and training?

Question 20: Are there other changes that might be needed to the Local Audit (Auditor Qualifications and Major Local Audit) Regulations 2014 alongside changes to the FRC’s guidance on Key Audit Partners?

Question 21: Are there other changes that we should consider that could help with improving the future pipeline of local auditor supply?

Question 22: Do you have any comments on the proposal to require smaller bodies to publish their budget statements and variance explanations alongside the Annual Governance and Accountability Return to aid transparency for local service users?

Question 23: is the current threshold of £6.5 million still right? If you think a different threshold would be more appropriate, please provide evidence to support this.

Question 24: Do you have any comments on the proposal for a requirement for smaller bodies to transfer to the Category 1 authority audit regime only once the threshold has been breached for 3 years in succession?

10. About this consultation

This consultation document and consultation process have been planned to adhere to the Consultation Principles issued by the Cabinet Office.

Representative groups are asked to give a summary of the people and organisations they represent, and where relevant who else they have consulted in reaching their conclusions when they respond.

Information provided in response to this consultation, including personal data, may be published or disclosed in accordance with the access to information regimes (these are primarily the Freedom of Information Act 2000 (FOIA), the Data Protection Act 2018 (DPA), the UK General Data Protection Regulation, and the Environmental Information Regulations 2004.

If you want the information that you provide to be treated as confidential, please be aware that, as a public authority, the Department is bound by the Freedom of Information Act and may therefore be obliged to disclose all or some of the information you provide. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on the Department.

The Ministry of Housing, Communities and Local Government will process your personal data in accordance with the law and in the majority of circumstances this will mean that your personal data will not be disclosed to third parties. A full privacy notice is included below.

Individual responses will not be acknowledged unless specifically requested.

Your opinions are valuable to us. Thank you for taking the time to read this document and respond.

Are you satisfied that this consultation has followed the Consultation Principles? If not or you have any other observations about how we can improve the process please contact us via the complaints procedure.

11. Personal data rights

The following is to explain your rights and give you the information you are be entitled to under the Data Protection Act 2018.

Note that this section only refers to your personal data (your name address and anything that could be used to identify you personally) not the content of your response to the call for evidence.

1. The identity of the data controller and contact details of our Data Protection Officer

The Ministry of Housing, Communities and Local Government (MHCLG) is the data controller. The Data Protection Officer can be contacted at dataprotection@communities.gov.uk

2. Why we are collecting your personal data

Your personal data is being collected as an essential part of the call for evidence process, so that we can contact you regarding your response and for statistical purposes. We may also use it to contact you about related matters.

3. Our legal basis for processing your personal data

The Data Protection Act 2018 states that, as a government department, MHCLG may process personal data as necessary for the effective performance of a task carried out in the public interest. i.e. a call for evidence.

4. With whom we will be sharing your personal data

We use a third-party platform, Citizen Space, to collect consultation responses. In the first instance, your personal data will be stored on their secure UK-based servers.

5. For how long we will keep your personal data, or criteria used to determine the retention period

Your personal data will be held for 2 years from the closure of the call for evidence.

6. Your rights, e.g. access, rectification, erasure

The data we are collecting is your personal data, and you have considerable say over what happens to it. You have the right:

a. to see what data we have about you

b. to ask us to stop using your data, but keep it on record

c. to ask to have all or some of your data deleted or corrected

d. to lodge a complaint with the independent Information Commissioner (ICO) if you think we are not handling your data fairly or in accordance with the law. You can contact the ICO at https://ico.org.uk/, or telephone 0303 123 1113.

7. Your personal data will not be sent overseas

8. Your personal data will not be used for any automated decision making

9. Your personal data will be stored on a secure government IT system

Your data will be transferred to our secure government IT system as soon as possible after the consultation has closed, and it will be stored there for the standard 2 years of retention before it is deleted.