Ask Our Experts: Understanding American CBD Consumers

Q: Given the common advertising barriers and marketing challenges facing CBD producers in the U.S. and abroad, how might companies set themselves apart from the competition?

A: Currently, the United States’ is the world’s largest market for hemp-derived CBD. Consumers have access to a wide variety of product forms, from edibles and beverages to bath bombs and lotions. Given the industry’s exponential growth during the past few years, along with CBD’s overall novelty, New Frontier Data has been busily working to collect information and better understand consumer perceptions about, uses for, and attitudes regarding the popular cannabinoid. The better that a company knows its customers, the healthier that its sales should be.

New Frontier Data’s latest release, the U.S. CBD Consumer Report: Archetypes and Preferences, features in-depth consumer research about CBD throughout the global marketplace. Building upon a previous work exploring the EU’s CBD market, the new report highlights CBD consumers’ preferences, purchasing behaviors, and use patterns across a range of demographic segments, in order to provide a granular understanding of the current American CBD market. Additionally, New Frontier Data has identified a spectrum of CBD consumer archetypes — including both current CBD consumers and nonconsumers — which define groups based upon their respectively distinct patterns of behavior and consumption.

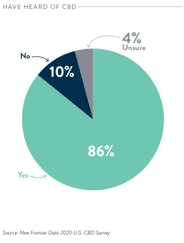

Drawing from a nationally representative survey of respondents from across the U.S., we found that CBD enjoys widespread name recognition and awareness among the general public. The overwhelming majority (86%) of respondents indicated having heard of CBD. Beyond such a nearly universal awareness about it, Americans also hold broadly positive feelings about CBD. Among all respondents, 48% reported feeling generally positive about CBD, a figure which increases to 84% among those who themselves had used CBD products.

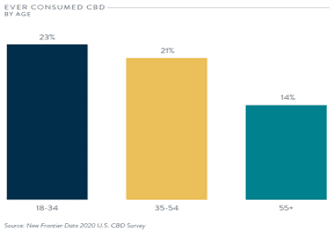

With high awareness fueled by societally broad media attention and availability among mass-market retailers, use rates are slowly increasing. The survey revealed that roughly 1 in 5 (18%) of Americans reported having tried CBD. Younger respondents, between the ages of 18-34, were more likely (23%) to have tried CBD than were older groups: Respondents aged 55 and older were the least likely (14%) to report having tried CBD.

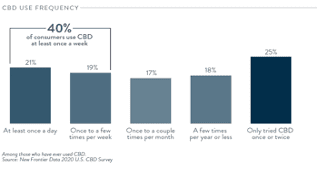

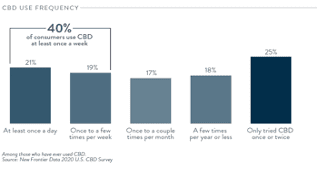

As popular consumption of CBD continues to grow, consumers accordingly grow more curious about the cannabinoid, with many reportedly planning to try it. Among all survey participants, 3 out of 10 Americans (29%) reported that they were likely to purchase CBD in the following six months. Experienced CBD consumers skew even more enthusiastically, with 72% of those who had previously purchased it saying that they remained likely to purchase it again in the following six months. Such repeat consumers appear to be well satisfied with the products that they have been purchasing, and inclined to consider CBD further.

Social networks collectively play a significant role in whether individuals report having tried CBD products. Among existing consumers, 88% reported having friends or family who also used CBD. Similarly, 84% of CBD consumers said that they had it personally recommended to them. In turn, 56% of those consumers in turn recommended CBD to someone else.

The U.S. CBD survey is the latest in an ongoing series of New Frontier Data’s research examining the legal cannabis marketplace in the United States and internationally, intended to provide in-depth insights into the expanding opportunities and policies throughout the cannabis industry.