This week, the Rail, Maritime and Transport (RMT) union announced a national three-day strike across the UK rail network. The strike, which is scheduled to take place on Tuesday 21st, Thursday 23rd and Saturday 25th June and cover over 40,000 rail workers across the UK, comes following fraught negotiations over jobs, pay and pensions. According to the RMT, this would mark the biggest rail walkout since 1989. Notably, the strike taking place on Tuesday 21st June also includes London Underground RMT members, spelling additional disruption to commuters in the capital.

If the strike goes ahead as planned, it is likely to cause some significant economic costs across the country. A core component of this is the fact that many workers rely on tube and rail to get to work, which will be made more difficult or in some cases impossible during the strike. The resultant loss to output, or Gross Value Added (GVA), depends on the extent to which people are able to work from home, thereby making themselves independent of the commuting transport infrastructure. The share of people able to work from home has of course seen a sharp rise over the pandemic period. According to recent data from the Office for National Statistics (ONS), 53.5% of workers report being able to work from home. [1] Many of the remaining 46.5% of workers will, however, not be able to reach their place of work amid the almost complete shutdown of the rail network.

In order to estimate the significance of this for the UK economy, we have taken regional homeworking data from the ONS, along with regional rail commuter data from the Department for Transport. Along with the estimated share of workers that cannot find other means of getting to work [2] and the share of services affected, our calculations point to 0.8% of the UK workforce (or over 250,000 people) being unable to work as a result of the strike on its first day.

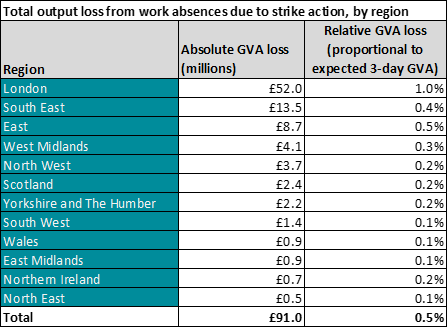

Accounting for the monetary cost of staff absences, this equates to a total estimated output loss of £91.0 million across the three days of strikes. Just short of half of this cost, equating to £45.1 million, is set to be felt on the first strike day – Tuesday 21st June, given that this is a weekday with a greater number of commuters, as well as the additional London Underground strikes planned for the same day. Following this, total output losses on the second day of strike – Thursday 23rd June – are expected to stand at £26.3 million. Meanwhile, the cost on the final strike day – Saturday 25th June – is estimated to stand at a lower £19.6 million, as a result of lower commuting on weekends.Studying the results on a regional basis reveal that the capital is set to face the largest hit to GVA from strike action, both in relative and absolute terms. At £52.0 million, the output loss due to strike action across London is set to reduce total GVA in the capital across the three-day period by 1.0%. This is predominantly due to the double impact of national rail and London Underground services on the first strike day in the capital. Following this, the South East is expected to face the next largest GVA loss, at £13.5 million, or 0.4%. A similarly high relative value is seen in the East of England. These results predominantly reflect the relatively high usage of rail transport for commuting in such regions.

The national strike will likely see further economic disruption by causing a loss of earnings for the workers and rail companies involved with the walkout, reducing spending by those who travel by rail to shop, knock-on effects for tourism spending, and the potential to significantly intensify existing supply chain disruptions. Indeed, on the latter point, Network Rail has suggested that certain freight trains will take priority over passenger services on the days in question, in order to ensure that the transport of vital goods across the country can be maintained. The importance of rail freight as opposed to transporting goods by truck has become ever greater in light of the shortage of HGV drivers and efforts to reduce carbon emissions. Disruption will also likely be experienced by many of those attending Glastonbury Festival, as well as those attending a number of high-profile sporting events.

Moreover, the switch away from rail transport and towards car usage, where possible, will be particularly painful in light of the record highs in petrol prices observed in recent days. Data from the RAC this week showed the average cost of filling a family car reaching above £100 for the first time, with little prospect for drastic price reductions in the weeks ahead.

The economic fallout from rail strikes would come on top of an increasingly gloomy outlook for the UK economy. Cebr now expects the UK economy to enter a technical recession (two consecutive quarters with declining GDP) across Q2 and Q3 2022, with respective quarterly contractions of 0.4% and 0.5% anticipated. Additional disruption to an already fragile outlook is therefore not welcome from an economic perspective. We can, however, thank the significant shift towards homeworking seen during the pandemic for what will likely be a persistent shielding effect to future commuting disruptions.

For more information please contact:

Karl Thompson, Economist Email kthompson@cebr.com Phone 020 7324 2850

Austin Boyd, Economist Email aboyd@cebr.com Phone 020 7324 2850

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership. For more information on this report, or if you are interested in commissioning research with Cebr, please contact us using our enquiries page.