Soaring natural gas prices are doing more than anything else – even the Government’s impending tax hike – to take money out of people’s pockets. Inflation is set to hit 7.25% in April as Ofgem ratchets up the energy price cap, adding an extra £693 to the average household energy bill. Global gas market fundamentals, meanwhile, suggest prices could remain elevated for several years.

Against this backdrop, it’s hardly surprising that some people are looking to reopen the debate on fracking in the UK. But if we’re going to have this discussion, it’s important to make sure we’re all on the same page – there are a lot of misconceptions doing the rounds on both sides.

Unsurprisingly, advocates of fracking point to the enormous impact shale exploration has had in the United States. In many ways, the shale revolution exemplifies the genius of American capitalism. Something that began with a few trailblazing entrepreneurs pushing forward the technological frontier culminated in something more akin to digitally-enabled mass production than traditional resource extraction – Fordism, but applied to the great mineral bounties of the earth.

The results have been spectacular. US shale oil production has increased by an average of 15% per annum over the last decade, and shale gas by 11%. Ten years ago, America accounted for around 9% and 18% of total (conventional and unconventional) global oil and gas production; today it accounts for roughly 18% and 25%. Thanks to the shale revolution, it now produces more natural gas than Russian, Qatar and Australia – the three other key players in global gas markets – combined.

Unfortunately for the UK, most of that gas output is trapped stateside. For various reasons, export infrastructure capacity has not kept pace with rising output. Even with extra export capacity set to come online this year, it will still only account for 15% of America’s total gas output – and no extra capacity is expected until 2024 at the earliest.

That’s why US benchmark gas prices are currently five times lower than European equivalents: seaborne liquefied natural gas (LNG) trade is gradually stitching regional gas markets together, but it is a still a bit of a misnomer to speak of a single global gas market.

Fracking in the UK

So, if we cannot rely on cheap US shale gas for the next few years, what might fracking in the UK look like?

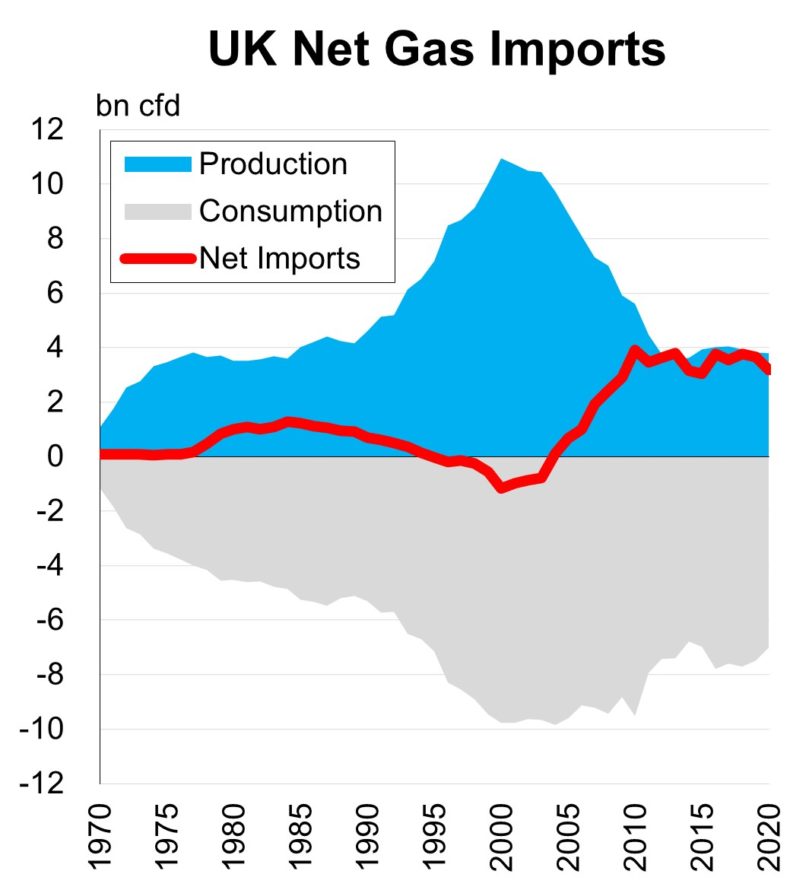

Due to stagnating North Sea output, UK net gas imports have averaged around 3.8bn cubic feet per day (cfd) over the last decade, as indicated by the graph below. Could fracking feasibly close the gap between production and consumption and have a material impact on UK gas prices?

.

.

Some very rough, back-of-the-envelope calculations suggest the answer could be ‘yes’. The average shale gas well produces at around 10m cfd (though some produce at eight times that rate) before hyperbolic decline sets in. If the same rates were achieved in the UK, then around 400 shale wells producing at any one time would close the 4bn cfd gap between production and consumption.

Assuming 30 days to drill and complete a well (quite long by current US standards), and assuming 40 rigs working simultaneously (about 5% of the number active in the US when output is rising), then shale gas output could theoretically approach 4bn cfd in 10 months. Would this blight the British countryside? Not really – the total surface area covered by well pads would be between one and two square miles.

You would have to keep drilling of course, because of the relatively rapid decline rates at unconventional wells. You would also need to lay pipelines to get the gas from wells to storage. And you would have to import expertise, at least to being with. But if the political will were there, getting a 4bn cfd UK fracking industry up and running in 12-18 months is probably not beyond the realms of possibility – if, that is, there is enough economically accessible shale gas in the UK.

Unfortunately, we have almost no idea what UK shale reserves might be – which is why claims about Britain sitting on £1 trillion of gas reserves should be taken with a pinch of salt. Without getting too technical, standard practice in the oil and gas sector is to quote ‘2P reserves’ – the sum of ‘proven’ and ‘probable’ reserves. But testing to date has been minimal: while the USA was being transformed into an energy superpower, the Coalition Government crushed the nascent UK shale sector beneath a mountain of regulations. The best we have are some pretty nebulous numbers for shale resources – but resources are very, very different from reserves.

In fact, resources are basically the portion of in-place oil or gas technically recoverable with current technology – right down to the last, marginal barrel, even if it costs $1,000 to get out of the ground. As extraction technology improves, so do resources. In contrast, reserves are the proportion of resources that are economically recoverable at current commodity prices. Reserves therefore go up and down with market cycles (though they tend to trend upwards over the long run, as new technology improves project economics on the cost side).

Crunching the numbers

The British Geological Society estimates the UK’s most promising basin, the Bowland shale, holds somewhere between 800 and 2,300tn cubic feet of gas in total. Looking at analogous sites in the US suggests that of that there might be between 120 and 350tn cf of gas resources in the Bowland, of which a certain fraction would be economically extractable, especially at current gas prices. And bear in mind that just 15 trillion cf of 2P reserves would provide 10 years of production at 4bn cfd, closing the gap between Britain’s consumption and production. But these are just estimates and unless we get drilling, we can’t even begin to firm them up.

Estimating reserves is complicated by the fact that the cost base of shale production is likely to be higher in the UK than in the US, for a number of reasons. Firstly, Britain is just much smaller. That means less scope for economies of scale and Fordian production methods compared to the vast open plains of Texas and North Dakota (Britain could fit into Texas almost three times over). Narrow roads and fewer options for pipelines mean that logistics are likely to be less efficient as well.

On top of this, the American shale revolution was underpinned by a liquid and dynamic market in mineral rights – US landowners have rights all the way down. In the UK though, oil and gas belong to the Crown Estate. Exploration and production rights to particular ‘blocks’ – in the North Sea for example – are sold to energy companies in periodic auctions. Blocks can then be sold from company to company, but there is more regulatory friction here than in the US.

A flipside to this is that proceeds from shale auctions, were they to happen, could be invested in local services or used to fund energy bill rebates for people in places where fracking was set to take place. This might help overcome local opposition to fracking, although worries (not entirely unfounded, though somewhat overblown) about earthquakes and groundwater contamination are likely to persist.

Environmental campaigners also argue that a UK shale gas sector would be incompatible with the country’s Net Zero 2050 goal. But before 2019, it was pretty widely assumed that natural gas was going to be a necessary ‘bridging fuel’ to a low carbon future, as I have noted previously. While renewables are growing rapidly, they are growing from a small base: something is going to be needed to plug the gap in the short-to-medium term. One plausible alternative – rolling blackouts – would just delegitimise the entire endeavour.

Moreover, the shale sector has long-term synergies with green energy. For example, new natural gas infrastructure can be repurposed for hydrogen quite easily, so it won’t become stranded as the energy transition progresses – and ultimately could prove a boon for Britain’s rapidly developing hydrogen industry. So could a workforce of engineers with highly transferable skills. Developments in shale drilling and other subsurface technologies, meanwhile, are opening up incredible possibilities for geothermal energy.

As with most things in energy and environmental policy, fracking is neither inherently ‘good’ or ‘bad’. Opponents raise legitimate concerns about environmental damage. Proponents are enthused by American precedent. Both sides tend to either exaggerate or downplay the trade-offs involved. In reality, fracking in the UK would probably play out quite differently from in the US. It would certainly not herald some kind of environmental apocalypse. And while it might make a big difference to our energy sector – we just don’t have enough data to be sure – we should wary of treating fracking as some kind of magic bullet.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.